Base Oil’s CFR India Price Loses Ground during Fourth Quarter of 2012

The global base oil market has seen remarkable changes in the last 20 years, a trend that is likely to continue as original equipment manufacturers (OEMs) continue to seek improvement in finished lubricant quality. While most of the changes have taken place in North America and Europe, the Asian market has proven to be the world's next supplier of high-quality base oil.

In Asia, new capacity for the production of Group II, II + and III base oils has been added. It is expected that the market will keep growing as OEMs push for the same quality of lubricants across the world. In India, base oil is produced by three state oil refiners: Indian Oil Corporation Ltd., Hindustan Petroleum Corporation Ltd., Bharat Petroleum Corporation Ltd. Indian Oil Corporation produces Group I base oil at its Chennai refinery and Group II base oil at Halida. Hindustan Petroleum Corporation Ltd. produces Group I base oil at its Mahul refinery. Bharat Petroleum Corporation Ltd. produces Group II+ base oil at its Sewri plant. Most of the base oil requirements of India are sourced by imports.

Major base oil imports are sourced from South Korea, the United States, Taiwan, Italy, Russia, Singapore, UAE, Netherlands, Bahrain, Thailand, Malaysia, Pakistan and Finland, which comprises:

1.Group I (N–70/150/500/Bright Stock)

2.Group II (N–60/70/150/250/500/600)

3.Group III (4Cst, 6Cst and 8Cst).

Major Indian base oil importers include:

Castrol Ltd.

Shell India,

Valvoline,

Total Lubricants,

Gulf Oil Corporation Ltd.

Apar Industries Ltd.

Savita Chemicals Ltd.

Raj Petro Specialties Pvt. Ltd.

Colombia Petro Chemicals Pvt. Ltd.

Panama Petro Chem Ltd.

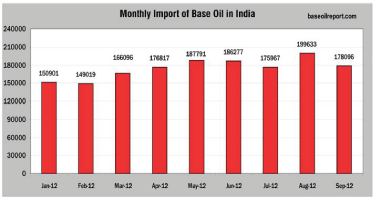

India’s appetite for base oil continues to grow rapidly. Average base oil imports during the period from January to September 2012 were approximately 175000 metric tons (MT), which comprise base oil Groups I, II and III as well as all the grades. The country imported:

India’s appetite for base oil continues to grow rapidly. Average base oil imports during the period from January to September 2012 were approximately 175000 metric tons (MT), which comprise base oil Groups I, II and III as well as all the grades. The country imported:

150901 MT of base oil in January 2012,

149019 MT in February,

166096 MT in March,

176817 MT in April,

187791 MT in May,

186277 MT in June,

175967 MT in July,

199633 MT in August and

178096 MT in September 2012.

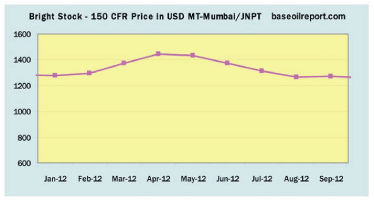

Lighter grade Groups I and II base oils (N-60/70/TOBS/SN-70/SN-90) imports comprised 37 percent of the total base oil imports during the period from January to September 2012. Bright Stock - 150 CFR India prices were oscillating in the range of:

Lighter grade Groups I and II base oils (N-60/70/TOBS/SN-70/SN-90) imports comprised 37 percent of the total base oil imports during the period from January to September 2012. Bright Stock - 150 CFR India prices were oscillating in the range of:

USD 1265-1280 per metric ton (PMT) in January 2012,

USD 1285-1300 (PMT) in February,

USD 1365-1380 (PMT) in March,

USD 1435-1450 (PMT) in April,

USD 1390-1405(PMT) in May,

USD 1365-1380 (PMT) in June,

USD 1305-1320 (PMT) in July,

USD 1255-1270 (PMT) in August,

USD 1250-1265 (PMT) in September.

Since January 2012, prices have decreased by USD 15 PMT (1 percent) through September 2012.

Since January 2012, prices have decreased by USD 15 PMT (1 percent) through September 2012.

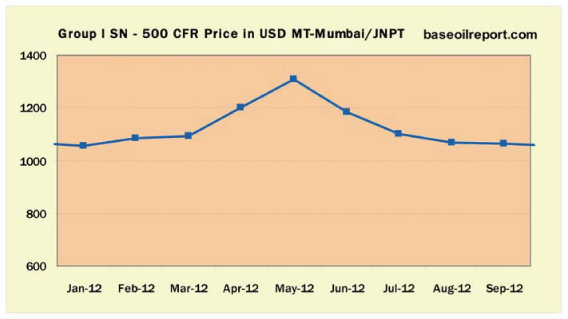

Group I SN 500 base oil CFR India prices were hovering in the range of :

USD 1165-1060 PMT in the month of January 2012, whereas further prices hiked up and reported at:

USD 1075-1095 PMT in February,

USD 1085-1100 PMT in March,

USD 1190-1205 PMT in April,

USD 1300-1315 PMT in May,

USD 1175-1190 PMT in June,

USD 1090-1105 PMT in July,

USD 1060-1075 PMT in August,

USD 1045-1060 PMT in September.

Since January 2012, prices have remained steady through September 2012.

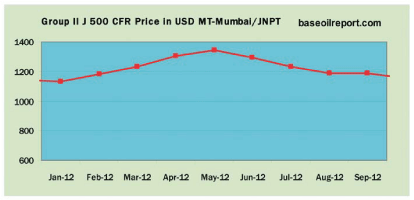

Group II J 500 CFR India prices were hovering in the range of:

Group II J 500 CFR India prices were hovering in the range of:

USD 1120-1135 PMT in January 2012,

USD 1170-1185 PMT in Feburary,

USD 1220-1235 PMT in March,

USD 1295-1310 PMT in April,

USD 1335-1350 PMT in May,

USD 1285-1300 PMT in June,

USD 1220-1235 PMT in July,

USD 1180-1195 PMT in August,

USD 1145-1160 PMT in September

Since January 2012, prices have increased by USD 25 PMT (2 percent) through September 2012.

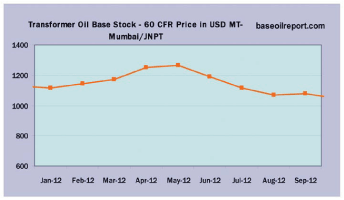

Transformer Oil Base Stock-60 CFR India prices were oscillating in the range of:

Transformer Oil Base Stock-60 CFR India prices were oscillating in the range of:

USD 1105-1120 PMT in January 2012,

USD 1135-1150 PMT in February,

USD 1160-1175 PMT in March,

USD 1240-1255 PMT in April,

USD 1255-1270 PMT in May,

USD 1180-1195 PMT in June,

USD 1105-1120 PMT in July,

USD 1060-1075 PMT in August,

USD 1035-1050 PMT in September.

Since January 2012, prices have decreased by USD 70 PMT (6 percent) through September 2012.

Indian State Oil PSU’s IOC/HPCL/ BPCL prices are mostly determined on import parity basis. They offer substantial discounts on the listed price for lifting more than 1500 MT by the buyers.

The Petrosil Base Oil Report (www. baseoilreport.com) offers solutions to the entire base oil value chain, from refiners, suppliers, buyers, traders, agents, consultants, lubricant companies, professionals and logistic providers as well as any other entity of the base oil value chain. The Base Oil Report is a comprehensive marketplace for global base oil reporting and trading.

Our subscribers can use this exclusive and unique base oil gateway to access information from the different sections and post and reply to international base oil offers. The gateway offers integrated solutions and is an essential tool for members who want to enhance their trading opportunities and access timely base oil news, prices and analysis.