Base Oil Report

Indian Rupee Tumbles against Dollar, State Oil PSU's Base Oil Numbers Shoots up.

Future looks bleak for India with unstable rupee and rising Crude oil prices. Oil prices pushed closer to $102 a barrel on Wednesday July 3, 2013 the highest level in over a year – due to Egyptian crisis. Traders are worried about disruptions of crude oil supplies from Mideast while anticipating an increase in oil demand in the US. Oil last crossed $100 a barrel on September 14 2012. Meanwhile, the Indian Rupee again breached the key Rs.60 mark against the US dollar on July 3, 2013. Falling rupee means more expenditure to buy oil in international market. As oil prices climb, the situation looks grim and India is in for double whammy.

Why Egypt matters in oil? Egypt is not an oil producer but its control of the Suez Canal, one of the world's busiest shipping lanes which link the Mediterranean with the Red Sea. This gives it a crucial role in maintaining global energy supplies. At the same time, rising tensions in Libya also hit oil prices. Oil workers at the Zueitina Oil Co. shut down several fields demanding changes in management, and the country's Sahara oil field stopped production over a security dispute. Because of this nearly a third of Libya's production has been affected.

India's Base oil market has become a matured one growing at 7% to 8% per annum. Most of the base oil is imported, with no major expansion seen in near future by the Indian State Oil Base Oil producers IOC/HPCL/ BPCL/Chennai Petroleum.

With a population of about 1.27 billion and estimated current annual GDP growth of 5 percent, as per the reports the nation anticipates high growth in its automotive industry and corresponding growth in lubricants. Total base oil demand in India today is 2.4 million metric tons with IOC/ BPCL/HPCL/Chennai Petroleum producing 605,000 MT per annum of Group I and 525,000 MT per annum of Group II Base Oils.

India's Group I Base Oil demand is likely to fall from today's 60 percent to 45 percent by 2018, while Group II demand is expected to rise from 20% now to 25% by 2018. Naphthenic, Vegetable Oils and Esters are also expected to grow from 20 percent today to 30 percent in the next five years.

The transformer oil market is estimated to grow to about 350,000 tons by 2018 which will move towards Napthenics Oil progressively. At the current level 80% of transformer oil is Paraffinic. GTL, Pale oils are estimated to account for 30 percent of the transformer oil market by 2018.

Group III Base Oils and Polyalphaolefins will be a need for extended oil drains and efficiency improvements.

Below are Base Oil Group I & Group II CFR India prices: The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades.

| Month | Group I SN 500 Iran Origin | N-70 Korean Origin Base Oil | N-500 Korean Origin Base Oil | J-150 Singapore Origin Base Oil |

|---|---|---|---|---|

| January 2013 | 870 – 880 | 940 – 950 | 1005 – 1015 | 995 – 1005 |

| February 2013 | 915 – 925 | 965 – 975 | 1035 – 1045 | 1020 – 1030 |

| March 2013 | 995 – 1005 | 990 – 1000 | 1090 – 1100 | 1075 – 1085 |

| April 2013 | 1040 – 1050 | 1030 – 1040 | 1110 – 1120 | 1080 – 1090 |

| May 2013 | 1035 – 1045 | 1035 – 1045 | 1095 – 1105 | 1075 – 1085 |

| June 2013 | 1020 – 1030 | 995 – 1005 | 1080 – 1090 | 1070 – 1080 |

| Between January and June 2013 prices are up by USD 150 PMT (17%) | Between January and June 2013, prices are up by USD 55 PMT (6%) | Between January and June 2013, prices are up by USD 75 PMT (7%) | Between January and June 2013, prices are up by USD 75 PMT (8%) |

During the month of May 2013, approximately 180203 MT of base oils of all the grades have been procured at Indian Ports. Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU IOC have marked up their base oil prices for Group I & II by Rs 4.00/4.00/3.50/5.10 per liter on their basic price for their grades SN 70 — H–70/SN 150 —H–150/SN 500 —H–500/Bright Stock effective July 1 2013. BPCL prices are also inched up by Rs 4.00/4.00/3.50 for the grades N–65/150/500 respectively. HPCL also marked their numbers for SN — 70/150/500/ BS–150 by Rs 4.00/4.00/3.50/5.10 per liter on their basic prices. It is being given to understand that importer traders have been hit hard due to sharp devaluation of Indian Rupee against dollar to 60.15 whose payments towards L/C which was due during the month of May 2013. Hefty Discounts are offered by refi ners which are in the range of Rs. 12.00 – 15 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN –150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 57.55 — 57.75/57.75 — 58.30 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

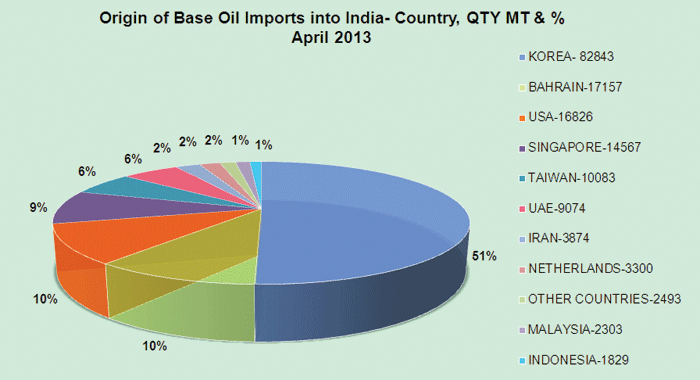

During the month of April 2013, India imported 164349 MT of Base Oil.

| Port | Qty in MT | Percent |

|---|---|---|

| Mumbai | 128374 | 78 |

| JNPT | 25129 | 15 |

| Ennore | 3122 | 2 |

| Kolkata | 2609 | 2 |

| Chennai | 2197 | 1 |

| Kandla | 1269 | 1 |

| Mundra | 119 | 1 |

| Others | 456 | 0 |

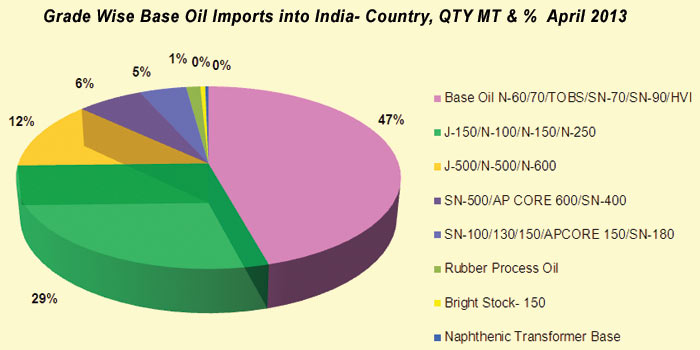

| Grade | Qty in MT | Percent |

|---|---|---|

| N-60/70/TOBS/SN-70/SN-90/HVI | 75024 | 47 |

| J-150/N-100/N-150/N-250 | 47632 | 29 |

| J-500/N-500/N-600 | 20019 | 12 |

| SN-500/AP CORE 600/SN-400 | 10531 | 6 |

| SN-100/130/150/APCORE 150/SN-180 | 7568 | 5 |

| Rubber Process Oil | 2267 | 1 |

| Bright Stock- 150 | 800 | 0 |

| Naphthenic Transformer Base Oil | 508 | 0 |