Base Oil Report

Base Oil becomes dearer as Rupee takes the toll

Crude Oil prices surged to a 27-month high of USD112.22 a barrel on August 28 amid indications the U.S. was close to taking military action against Syria for its alleged use of chemical weapons against civilians. But prices have since lost nearly 6% after the U.S. and Russia reached a diplomatic solution on how to handle Syria’s chemical weapons last week. While Syria is not a major oil producer, investors fear that the two year- old civil war could spill over to affect oil supplies in nearby countries. Reports that Libyan oil production is on the rise after protesters reopened access to facilities also added to the selling pressure, as did talk that oil output in Iraq is recovering. Countries in the Middle East were responsible for nearly 35% of global oil production in 2012. New York-traded crude oil futures fell to a one-month low on Friday, amid lingering uncertainty over the future of the Federal Reserve's stimulus program and as fears a disruption to supplies from the Middle East continued to fade away. On the New York Mercantile Exchange, light sweet crude futures for delivery in November declined 1.05% on Friday to settle the week at USD104.75 a barrel by close of trade. Prices fell by as much as 1.3% earlier in the day to hit a session low of USD104.51 a barrel, the weakest level since August 23. The November contract settled 1.3% lower at USD105.86 a barrel on Thursday. Oil futures were likely to fi nd support at USD103.56 a barrel, the low from August 22 and resistance at USD108.14 a barrel, the high from September 19. On the week, Nymex oil futures lost 2.6%, the biggest weekly decline since the week ended July 26.

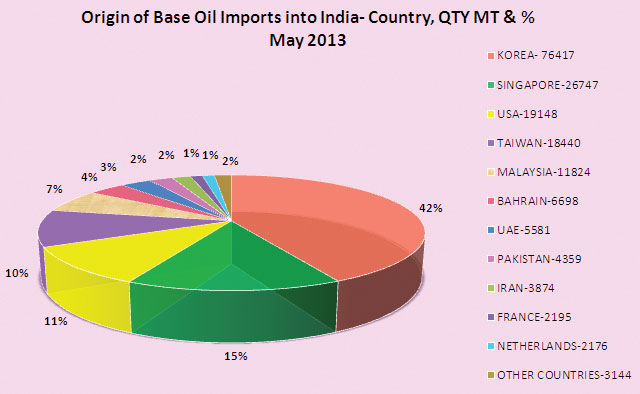

Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the period April to July 2013, approximately 690689 MT of base oils with an average of 172517 per month of all the grades have been procured at Indian Ports. Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc.

Indian State Oil PSU’s IOCL/HPCL/ BPCL announces hefty hike in base oil prices across the board effective from September 1st 2013. Prices for SN-70/ H-70/N-65/SN-150/H-150/N-150 have been increased by Rs.8.00 per liter on it basic price.SN-500/H-500/N-500 have been raised by Rs.9.10 per liter. Bright stock prices have gone up by Rs.10.40 per liter. The above hike have been attributed to sharp devaluation of Indian rupee against USD to Rs.66.00. For the second half of the current month, prices remain unchanged. It is being given to understand that importer traders have been hit hard due to sharp devaluation of Indian Rupee against dollar to 66.00 whose payments towards L/C was due during the month of August 2013. Hefty Discounts are offered by refiners which are in the range of Rs. 12.00 - 15 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 64.75 – 65.05/65.95 – 66.20 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

| Month | Group I - SN 150 Iran Origin | N-70 Korean Origin Base | N-150 Korean Origin | J-500 Singapore Origin |

|---|---|---|---|---|

| April 2013 | 1020 – 1030 | 1015 – 1025 | 1025 – 1030 | 1090 – 1110 |

| May 2013 | 1015 – 1020 | 1030 – 1035 | 1040 – 1050 | 1080 – 1095 |

| June 2013 | 1010 – 1015 | 1025 – 1030 | 1025 – 1035 | 1075 – 1090 |

| July 2013 | 980 – 985 | 985 – 995 | 1040 – 1050 | 1065 – 1075 |

| Aug 2013 | 960 – 965 | 975 – 980 | 1000 – 1010 | 1050 – 1055 |

| Since April 2013, prices has gone down by USD 60 PMT (6%) in August 2013 | Since April 2013, prices has decreased by USD 40 PMT (4%) in August 2013 | Since April 2013, prices has marked down by USD 25 PMT (2%) in August 2013 | Since April 2013, prices has dipped down by USD 45 PMT (4%) in August 2013 |

The Indian domestic market, Korean origin Group II plus N-60–70/150/500 prices marked up substantially due to sharp downfall of Indian Rupee. As per conversation with domestic importers and traders prices have inched up for all the above grades and at the current level are quoted in the range of Rs. 64.75 – 65.15/66.35 – 66.80/67.75 - 68.25 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs. 0.25 – 0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 65.65 – 66.75 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 72.55 – 75.00 per liter in bulk respectively plus taxes extra.

| Port | Qty in MT | Percent |

|---|---|---|

| Mumbai | 144525 | 80% |

| JNPT | 23047 | 13% |

| Chennai | 6385 | 4% |

| Ennore | 4442 | 2% |

| Others | 1804 | 1% |

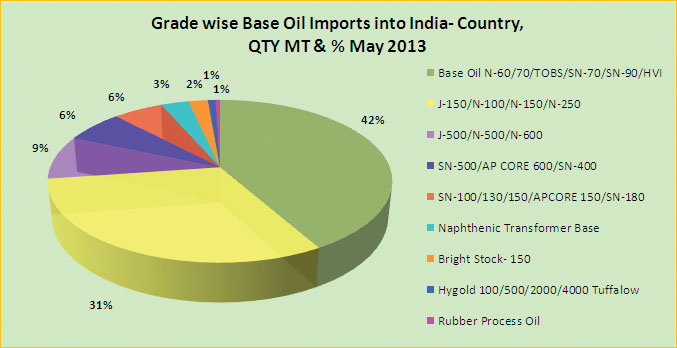

| Grade | Qty in MT | Percent |

|---|---|---|

| N-60/70/TOBS/SN-70/SN-90/HVI | 75225 | 42 |

| J-150/N-100/N-150/N-250 | 55841 | 31 |

| J-500/N-500/N-600 | 15758 | 9 |

| SN-500/AP CORE 600/SN-400 | 11587 | 6 |

| SN-100/130/150/APCORE 150/SN-180 | 9963 | 6 |

| Naphthenic Transformer Base | 5519 | 3 |

| Bright Stock- 150 | 3881 | 2 |

| Hygold 100/500/2000/4000 Tuffalow | 1516 | 1 |

| Rubber Process Oil | 913 | 1 |