Base Oil Report

Crude Oil imports of India are targeted around 9.5 million tonnes from Iran during 2014-15. India is targeting 11 million tonnes of crude oil import this fiscal despite buying only 5.82 million tonnes of crude oil from the Islamic nation during the fi rst eight months of current fi scal. India, which has been since last year cutting imports from Iran after US and European nations' sanctions made shipments and payments difficult, imported 13.14 million tonnes of crude oil from Iran in 2012-13, down from 18.11 million tonnes in the previous year. In November last year, the US and other western powers agreed to ease sanctions against Iran that would lift ban on insuring tankers carrying Iranian crude as well as open payment channels. As per the reports, Mangalore Refinery and Petrochemicals Ltd will import 4 million tons of crude from Iran this fiscal while Indian Oil Corp (IOC) has contracted 1.2 million tonnes. Private sector Essar Oil is likely to import 4 million tonnes. In 2010-11, India had imported 18.50 million tonnes of crude oil from the Persian Gulf state. India, which currently importing crude from over 30 countries, has not publicly said it was aiming to cut back oil imports from Iran but has unofficially asked its top importers to prune shipments from Tehran. Iran, which was India's second biggest supplier of crude oil after Saudi Arabia in 2010-11, slipped four places to become its seventh-largest crude oil supplier in 2012-13.

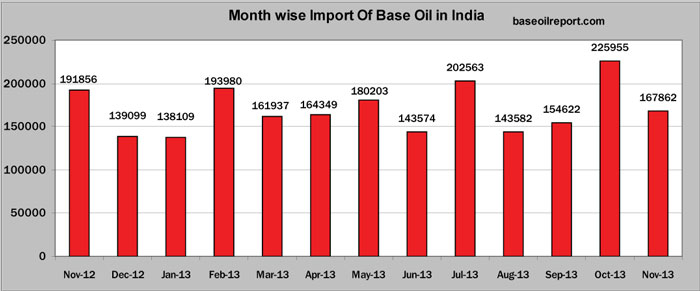

Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the period July to November 2013, approximately 894583 MT of base oils with an average of 178917 per month of all the grades have been procured at Indian Ports. Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc.

Indian State Oil PSU’s IOC / HPCL / BPCL. prices for SN-70 / N-70 / N-65 / SN-150 / N-150 / N-150 hiked by Rs 0.90 per liter on its basic prices, While SN-500/N-500/MakBase-500 were marked down by Rs 1.00 per liter. Bright stock prices were also down by Rs 2.00 per Liter, effective January 01, 2014 Hefty Discounts are offered by refiners which are in the range of Rs. 12.00-19.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN-150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 61.50-61.70 / 61.90-62.10 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern. The Indian domestic market Korean origin Group II plus N-60-70 / 150 / 500 prices at the current; level is steady. As per conversation with domestic importers and traders prices have inched up for N-60 / N-150 grades and at the current level are quoted in the range of Rs. 61.50-61.60 / 62.75-62.95 / 64.50-64.70 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone.

The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs. 0.25-0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 62.60-62.70 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 67.15-67.90 per liter in bulk respectively plus taxes extra.

| Month | Group I - SN 500 Iran Origin | N-70 Korean Origin | J-150 Singapore Origin | Bright Stock USA |

|---|---|---|---|---|

| October 2013 | 950 – 960 | 1020 – 1030 | 1065 – 1075 | 1160 – 1170 |

| November 2013 | 950 – 960 | 1025 – 1030 | 1065 – 1075 | 1145 – 1155 |

| December 2013 | 925 – 935 | 1010 – 1015 | 1055 – 1065 | 1130 – 1140 |

| Since October 2013, prices has gone down by USD 25 PMT (3%) in December 2013 | Since October 2013, prices has decreased by USD 10 PMT (1%) in December 2013 | Since October 2013, prices has marked down by USD 10 PMT (1%) in September 2013 | Since October 2013, prices has dipped down by USD 20 PMT (2%)in December 2013 |

| Port | Qty in MT | Percent |

|---|---|---|

| Mumbai | 446973 | 81 |

| JNPT | 58717 | 11 |

| Chennai | 19575 | 4 |

| Ennore | 13676 | 2 |

| Kolkata | 6420 | 1 |

| Others | 3078 | 1 |

| Grade | Qty in MT | Percent |

|---|---|---|

| Base Oil N-60/70/TOBS/SN-70/SN-90/HVI | 213135 | 39 |

| J-150/N-100/N-150/N-250 | 190467 | 35 |

| SN-500/AP CORE 600/SN-400 | 52441 | 11 |

| J-500/N-500/N-600 | 42080 | 8 |

| SN-100/130/150/APCORE 150/SN-180 | 20655 | 4 |

| Naphthenic Transformer Base | 11395 | 2 |

| Bright Stock-150 | 5786 | 1 |

| Hygold 100/500/2000/4000 | 4450 | 0 |

| Rubber Process Oil | 2031 | 0 |