Base Oil Report

Crude-oil futures has seen a fall after the Organization of the Petroleum Exporting Countries cut demand forecasts for its oil and investors worried about the health of the eurozone’s economy. On the New York Mercantile Exchange, light, sweet crude futures for delivery in December CLZ4, -0.37% fell 77 cents, or 1%, to settle at $77.91 a barrel. December Brent crude LCOZ4, -0.66% on London’s ICE Futures exchange fell 9 cents, or 0.1%, to $82.86 a barrel. Both benchmarks are down for five out of the past six sessions and off nearly 30% from a June peak. OPEC said demand for its crude oil would fall to 28.2 million barrels a day by the end of 2017, as output from producers outside the cartel, such as the U.S. and Canada, Latin American countries, and Russia, continue to rise. Demand for OPEC crude will pick up again in 2018, but a year later it will still be lower than demand for 2013, OPEC said. Earlier in the week, futures had fallen to fresh multiyear lows. Investors remain worried about the combination of plentiful supplies and diminished demand, with all eyes on the coming OPEC meeting in two weeks. Investors will be parsing any signs that the cartel will cut its production – a move that would push prices higher. Saudi Arabia, the world’s No. 1 crude exporter and a key OPEC member, has not indicated it wants to follow that route. It recently cut prices for its oil sold to the U.S. and elsewhere, in a bid to preserve its market share rather than provide a floor to crude prices.

| Month | Group II - N 70 Korea | SN-500 Iran | Bright Stock - CFR | Base Oil HYGOLD L - 2000 |

| July 2014 | 1065 – 1075 | 1040 – 1045 | 1220 – 1230 | 1075 – 1085 |

| August 2014 | 1055 – 1060 | 1045 – 1055 | 1235 – 1245 | 1070 – 1085 |

| September 2014 | 1015 – 1020 | 1015 – 1020 | 1200 – 1210 | 1055 – 1060 |

| Since July 2014 prices down by USD 50 PMT (5%) in September 2014 | Since July 2014 prices has marked down by USD 25 PMT (2%) in September 2014 | Since July 2014 prices has gone down by USD 20 PMT (2%) in September 2014 | Since July 2014 prices has decreased by USD 20 PMT (2%) in September 2014 |

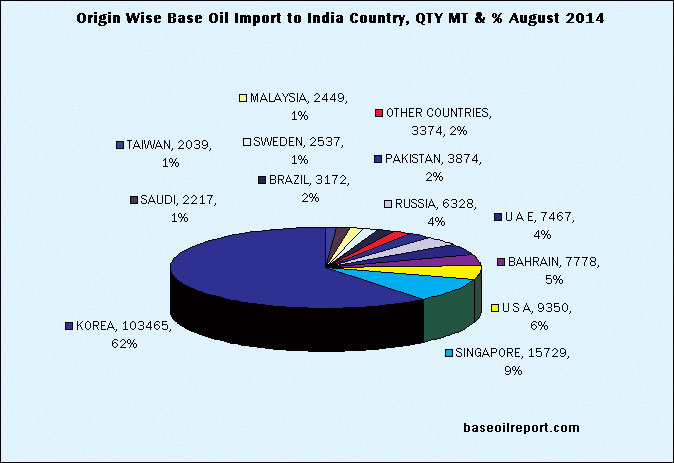

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of September 2014, approximately 205219 MT have been procured at Indian Ports of all the grades, which is 21 % up as compared to August 2014, Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL/BPCL basic prices for SN – 70/N – 70/N-65/SN – 150/N -150/N – 150 marked down by Rs. 1.90 per liter, while SN - 500/N - 500/ MakBase – 500 is down by Rs, 2.20 per liter. Bright Stock price is down by Rs. 0.30 per liter. Hefty Discounts are offered by refiners which are in the range of Rs. 13.00 – 15.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 57.00 – 57.45/57.50 – 57.75 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level have been marked down due to higher inventories level. As per conversation with domestic importers and traders prices refl ects marginal changes for N – 60/ N- 150/ N-500 grades and at the current level are quoted in the range of Rs. 55.25 – 55.30/57.10 – 57.30/58.10 – 58.55 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.25 – 0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 55.75 – 55.95 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 60.75 – 61.80 per liter in bulk respectively plus taxes extra.

Countries Where Transformer Oil Has Been Exported

- Bangladesh

- South Africa

- Brazil

- Sri Lanka

- Malaysia

- Saudi Arabia

- Djibouti

- Philippines

- Myanmar

- Thailand

- Iran

- Vietnam

- New Zealand

- UAE

- Oman

- Indonesia

- Paraguay

Countries Where Light & Heavy White Oil Has Been Exported

- Algeria

- Australia

- Argentina

- Bangladesh

- Brazil

- Bulgaria

- Cambodia

- Chile

- Colombia

- Dominican Re

- Djibouti

- Ecuador

- Egypt

- Germany

- Guatemala

- Ghana

- Greece

- Indonesia

- Ivory Coast

- Iran

- Israel

- Italy

- Jordan

- Kenya

- Malaysia

- Myanmar

- Nepal

- New Zealand

- Nigeria

- Pakistan

- Peru

- Philippines

- Poland

- Russia

- South Africa

- Senegal

- Spain

- Sri Lanka

- Sudan

- Taiwan

- USA

- Tanzania

- Thailand

- Turkey

- UAE

- UK

- Ukraine

- Vietnam

- Yemen

- Zaire