Base Oil Report

| Country | QTY in MT | % |

|---|---|---|

| Korea | 90223 | 52 |

| Singapore | 20645 | 12 |

| Bahrain | 11290 | 6 |

| Russia | 8855 | 5 |

| Taiwan | 7756 | 4 |

| USA | 6437 | 4 |

| UAE | 6349 | 4 |

| Italy | 4669 | 3 |

| Iran | 3194 | 2 |

| Brazil | 2826 | 2 |

| Saudi Arabia | 2380 | 1 |

| Spain | 2184 | 1 |

| Sweden | 1578 | 1 |

| Malaysia | 1197 | 1 |

| Qatar | 1180 | 1 |

| Other Countries | 3358 | 2 |

Crude oil prices rebounded in Asia on Monday Sept 8 2014 with last week's sharp fall providing room for bargain hunters. On the New York Mercantile Exchange, crude oil for delivery in October traded at $93.48 a barrel, up 0.20%, after tumbling last week to end down 1.23% at $93.29 a barrel. Last week, crude oil futures declined following the release of disappointing U.S. employment data and as Ukraine and pro-Russian separatists agreed to a ceasefire. Elsewhere, on the ICE Futures Exchange in London, Brent oil for October delivery slumped 0.99%, or $1.01, to settle at $100.82 a barrel by close of trade on Friday. For the week, the October Brent contract lost 2.29%, or $2.37 after Ukraine signed a ceasefire deal with pro-Russia rebels, taking the first step toward ending the five-month old conflict in eastern Ukraine.

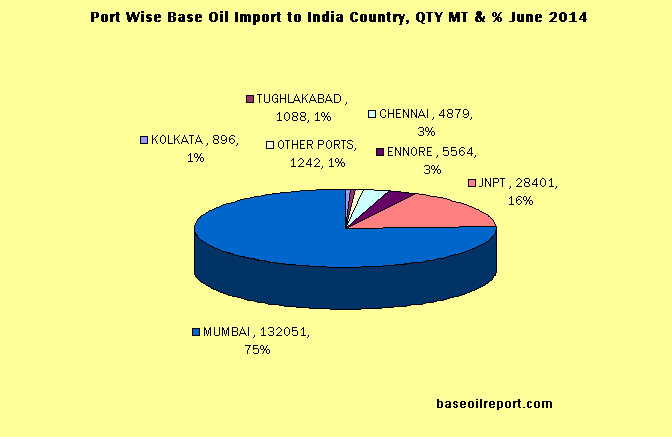

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of July 2014, approximately 220621 which are 27% up as compared to June 2014 have been procured at Indian Ports of all the grades The rates variance applicable effective Sept 01 , 2014. by PSU’s are as follows:

1. SN – 70/N – 70/N–65/SN – 150/N – 150/N – 150 : Rs 0.50 per Liter 2. SN – 500/N – 500/MakBase – 500 Rs. 0.40 per liter 3. Bright stock - Rs. 0.70 per Liter Hefty Discounts are offered by refiners which are in the range of Rs. 10.00 – 13.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN – 150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 60.80 – 61.15/61.10 – 61.40 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

| Month | Group II – N 500 Korea Origin | SN–150 Iran Origin | SN–500 Russia Origin | Napthenic Base Oil HYGOLD L 500 |

|---|---|---|---|---|

| July 2014 | 1130 – 1150 | 1020 – 1025 | 1050 – 1055 | 1070 – 1075 |

| August 2014 | 1145 – 1150 | 1025 – 1035 | 1050 – 1060 | 1080 – 1090 |

| September 2014 | 1145 – 1150 | 1025 – 1035 | 1050 – 1060 | 1075 – 1085 |

| 1080 – 1090 | 1025 – 1035 | 1060 – 1070 | 1130 – 1150 | |

| Since July 2014, prices jumped up by USD 20 PMT (1%) in September 2014 | Since July 2014, prices has marked up by USD 15 PMT (1%) in September 2014 | Since July 2014, prices has gone up by USD 10 PMT (1%) in September 2014 | Since July 2014, prices has increased by USD 20 PMT (2%) in September 2014 |

The Indian domestic market Korean origin Group II plus N–60–70/150/500 prices at the current; level is steady. As per conversation with domestic importers and traders prices refl ects marginal changes for N – 60/ N – 150/ N – 500 grades and at the current level are quoted in the range of Rs. 60.50 – 60.70/61.50 – 61.90/64.30 – 64.55 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.25 – 0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 61.50 – 61.70 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 65.75 – 66.00 per liter in bulk respectively plus taxes extra.

Approximately 9204 MT of Light & Heavy White Oil has been exported in the month of June 2014 from JNPT, Mundra, Raxaul LCS, and Chennai port. Compared to last month i.e. May 2014, exports of the country have gone up by 11% in the month of June 2014. Approximately 2516 MT of Transformer Oil has been exported in the month of June 2014 from JNPT and Chennai port. It has been exported to Bangladesh, Brazil, Malaysia, Iran, New Zealand, Oman, Paraguay, Morocco, Indonesia, South Africa, Sri Lanka, Saudi, Philippines, Thailand, Vietnam, and UAE, Turkey.

Indian lubricants industry growth is highly correlated to GDP growth. The per capita lubricant consumption in India is quite low compared to developed countries. However, even a comparison with other developing countries like China and Indonesia reveals that there is a significant potential for growth in lubricant consumption in India. If the economy improves further with the required investments then the entire lubricants industry is expected to witness a much positive growth in the coming years. As per the Reports, A big challenge which the industry currently facing is the awareness about available lubricants and right lubricant for right application. We expect increase in awareness and use of condition monitoring equipment in coming years. We will continue to see new technologies that assist in refining programs from testing lubricant properties to determining how the lubricant gets to the equipment. In India, users will continue to stress on product performance. We believe these technologies enable lubricant manufacturing companies and independent lubricant consultants to stress lubricant performance rather than price. Hence, due to increase demand for high performance products, condition monitoring and knowledge of product performance both will increase. There have been cultural challenges as well. Some OEMs and customers still perceive that thicker lubricants are better as they have grown with this old perception.

Countries from Where Base Oil is Imported

- Argentina

- Australia

- Bangladesh

- Bulgaria

- Cambodia

- Chile

- Domincian Republic

- Djibouti

- Ecuador

- Egypt

- Eritrea

- Germany

- Indonesia

- Ivory Coast

- Iran

- Israel

- Italy

- Morocco

- Kenya

- Malaysia

- Myanmar

- Nepal

- New Zealand

- Nigeria

- Pakistan

- Peru

- Philippines

- Poland

- Russia

- South Africa

- Senegal

- Spain

- Sri Lanka

- Sudan

- Taiwan

- USA

- Tanzania

- Turkey

- UAE

- UK

- Ukraine

- Vietnam

- Yemen

- Zaire