Base Oil Report

| Country | MT | % |

|---|---|---|

| Korea | 114,000 | 61% |

| Singapore | 20,540 | 11% |

| USA | 12,388 | 7% |

| UAE | 11,527 | 6% |

| Saudi | 10,211 | 5% |

| Pakistan | 3,176 | 2% |

| Bahrain | 2,547 | 1% |

| Brazil | 2,529 | 1% |

| Russia | 1,730 | 1% |

| Taiwan | 1,618 | 1% |

| Italy | 950 | 1% |

| Other countries | 3,486 | 2% |

Brent crude oil has seen a new low of almost 60 per cent in the past two quarters, currently around $51 a barrel, a level not seen in five and a half years. While many see the fall as a blessing for the macro economy, the decline is not so good for all businesses and markets. The real benefits can be seen when prices stabilise, preferably at levels acceptable to both consumers and producers. A lower crude oil price for a country like India (a third of our import bill is crude oil) is certainly beneficial, as it helps macroeconomic management.” It results in lower inflation, gives comfort to the Reserve Bank of India in cutting interest rates and flexibilities in budget and fiscal management.

Crude oil import in 2013-14 was $165 billion, about 36 per cent of the total import bill. In April-November 2014, it was $90.3 billion, about 28.3 per cent of the total import. India also exports petroleum products and in FY 14-15 till November, these were $42.6 billion or a fifth of total exports. Thus, India saves on foreign exchange. A 10 per cent reduction in crude oil prices could reduce Consumer Price Index-based inflation by around 20 basis points (bps) and bring about a 30 bps rise in gross domestic product (GDP) growth.

A $10 a barrel fall in oil prices reduces the country’s import bill and, hence, the current account deficit by $10 bn or 0.48 per cent of GDP. However, on the flip side, the sharp and immediate fall in crude oil prices has deeper implications on markets and the way businesses and companies operate. For example, $2 trillion of bank funding is involved in oil exploration and production activities, including in shale gas. With crude oil falling to around $50 a barrel, many projects are facing viability issues. When unviable for a long period, there will be either production cuts or the company might declare bankruptcy.

It would be wrong to ignore the potential downside risks associated with lower oil prices. Many oil producers, both companies and countries, are dependent upon high prices, and we should therefore expect to see an increase in bankruptcies and sovereign defaults as a result. As a country, India for sure stands to gain from lower crude oil prices. However, currency volatility and global economic slowdown might impact exports.

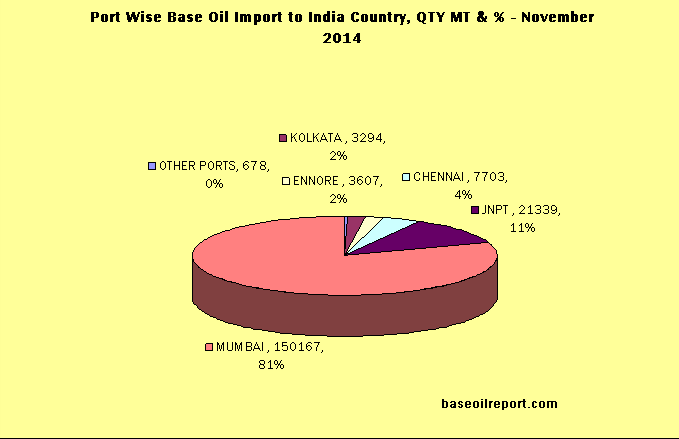

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of November 2014, approximately 186788 MT have been procured at Indian Ports of all the grades, which is 17% down as compared to October 2014. Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc.

Indian State Oil PSU’s IOC / HPCL / BPCL basic prices for SN – 70/N – 70/ N-65/SN – 150/N -150/N – 150 marked down by Rs. 4.00 per liter, while SN - 500/N - 500/MakBase – 500 is down by Rs, 3.80 per liter. Bright Stock price is down by Rs. 2.60 per liter. The prices are effective January 01, 2015. Hefty Discounts are offered by refiners which are in the range of Rs. 15.00 – 17.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 47.50 – 47.80/47.85 – 47.90 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

| Month | TOBS Korea | SN-150 Iran | Group II N - 500 CFR | Base Oil Bright Stock |

|---|---|---|---|---|

| October 2014 | 995 – 1000 | 1005 – 1010 | 1070 – 1080 | 1180 – 1200 |

| November 2014 | 955 – 965 | 930 – 940 | 985 – 990 | 1140 – 1160 |

| December 2014 | 860 – 870 | 870 – 880 | 880 – 895 | 1080 – 1090 |

| Since October 2014, prices down by USD 135 PMT (13%) in December 2014 | Since October 2014, prices has marked down by USD 135 PMT (13%) in December 2014 | Since October 2014, prices has gone down by USD 185 PMT (17%) in December 2014 | Since October 2014, prices has decreased by USD 105PMT (9%) in December 2014 |

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level have been marked down due to higher inventories level. As per conversation with domestic importers and traders prices reflects minimal changes for N – 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 47.10 – 47.30/48.10 – 48.25/47.90 – 48.30 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.25 – 0.35 per liter on basic prices.

Prices may decline further by another Rs,1.50–2.00 per liter due to lack of demand and high inventories. Light Liquid Paraffin (IP) is priced at Rs. 47.75–48.00 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 51.75–52.25 per liter in bulk respectively plus taxes extra.

Approximately 9547 MT of Light & Heavy White Oil has been exported in the month of November 2014 from JNPT, Raxaul LCS, Village Poneri and Chennai port. Compared to last month i.e. October 2014, exports of the country have gone down by 9% in the month of November 2014

Approximately 5997 MT of Transformer Oil has been exported in the month of November 2014 from JNPT, Village Ponneri and Chennai port.

Countries Where Light & Heavy White Oil Has Been Exported

- Australia

- Algeria

- Argentina

- Bangladesh

- Brazil

- Bulgaria

- Cambodia

- Chile

- Colombia

- Cuba

- Djibouti

- Ecuador

- Egypt

- Germany

- Guatemala

- Greece

- Hong Kong

- Indonesia

- Ivory

- Iran

- Coast

- Israel

- Italy

- Jordan

- Kenya

- Malaysia

- Myanmar

- Nepal

- Nigeria

- Pakistan

- New Zealand

- Peru

- Philippines

- Poland

- South

- Senegal

- Spain

- Srilanka

- Taiwan

- USA

- Tanzania

- Africa

- Thailand

- Turkey

- UAE

- UK

- Ukraine

- Vietnam

- Yemen

- Zaire