Base Oil Report

During the last few days crude-oil futures moved in a narrow price range in early Asian trade, with gains capped by worries about a recovery in U.S. shale-oil production and as OPEC’s meeting draws closer. On the New York Mercantile Exchange, light, sweet crude futures for delivery in June traded at $59.92 a barrel, up $0.23 in the Globex electronic session. July Brent crude on London’s ICE Futures exchange rose $0.16 to $66.97 a barrel. Nymex crude ended 0.5% higher last week and has been up for three consecutive weeks, while Brent crude gained 1% last week and has been up for seven of the past nine weeks. Oil-price gains were capped due to some weak U.S. economic data from last week and on worries U.S. shale production could recover quickly if prices kept on rising. Last week’s Baker Hughes U.S. drilling rig-count also lost momentum, falling by 8 rigs to 660 rigs, the smallest fall in 23 weeks. “Reports suggest certain shale formations (such as Eagle Ford and Bakken) are starting to add rigs, which is further weighing on sentiment,” ANZ Bank said. ICE gasoil for June changed hands at $613.75 a metric ton, up $2.75.

| Month | Group I–SN 500 Iran Origin | N-70 Korean Origin | J-150 Singapore Origin | HYGOLD L 2000 USA Origin |

| January 2015 | 750–760 | 735–745 | 760–770 | 770–775 |

| February 2015 | 635–645 | 655–660 | 680–690 | 685–695 |

| March 2015 | 590–600 | 635–640 | 665–670 | 670–685 |

| April 2015 | 620–630 | 665–670 | 695–700 | 700–715 |

| Since January 2015 prices have gone down by 60 (9%) in April 2015. | Since January 2015 prices have decreased by 65 (9%) in April 2015. | Since January 2015 prices have dipped down by 65 (8%) in April 2015. | Since January 2015 prices have gone down by 60 (8%) in April 2015. |

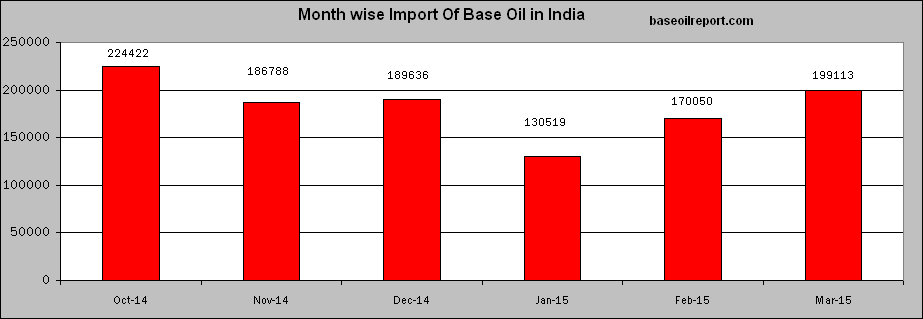

We can see that when Compared to the previous month i.e. February 2015. Base Oil import of the country has increased by 13% in March 2015. Compared to the same month last year i.e. March 2014, Base Oil import has gone up by 17% in March 2015.

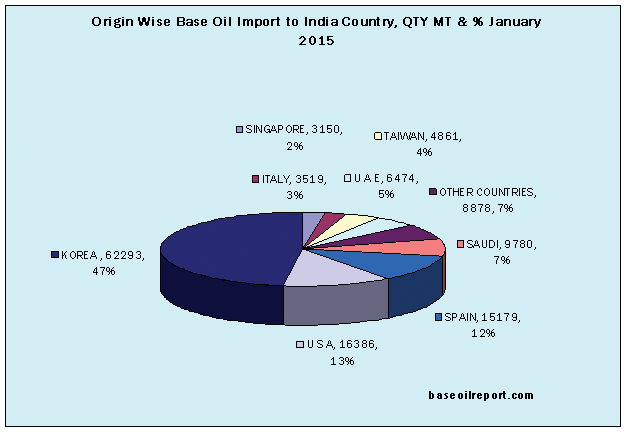

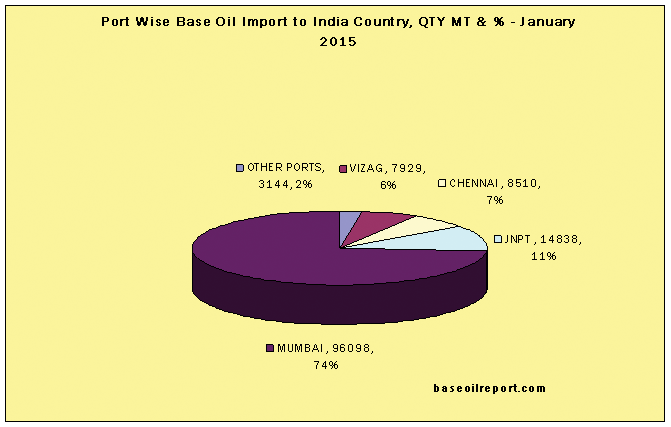

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of March 2015, approximately 199113 MT have been procured at Indian Ports of all the grades, which is 17% up as compared to Feb 2015, Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL basic prices for SN – 70/N – 70/SN – 150/N -150 marked up marginally by Rs. 0.80 per liter, while SN - 500/N - 500 is jumped by Rs.3.00 per liter. Bright Stock price is up by Rs. 1.70 per liter. The prices are effective May 01, 2015. As per the information there is no change in the prices for the second half of current year. Hefty Discounts are offered by refiners which are in the range of Rs. 15.00 – 17.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 44.70 – 44.80/45.70 – 45.95 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level have been marginally up. As per conversation with domestic importers and traders prices reflects minimal changes for N – 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 44.65 –44.95/46.30 – 46.60/47.80 – 48.40 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.35 – 0.45 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 44.95 – 45.40 per liter in bulk and Heavy Liquid paraffin (IP) is Rs.49.50 – 50.50 per liter in bulk respectively plus taxes extra.

Export of Light & Heavy White Oil

- Argentina

- Algeria

- Australia

- Bangladesh

- Brazil

- Bulgaria

- Cambodia

- Chile

- Djibouti

- Egypt

- Finland

- Greece

- Guatemala

- Indonesia

- Iran

- Italy

- Jordan

- Kenya

- Kuwait

- Malaysia

- Mozambique

- Myanmar

- Nepal

- New Zealand

- Nigeria

- Pakistan

- Peru

- Philippines

- Poland

- Russia

- South Africa

- Senegal

- Singapore

- Spain

- Sri Lanka

- Taiwan

- Tanzania

- Thailand

- Turkey

- UAE

- UK

- USA

- Ukraine

- Vietnam

- Yemen

- Yugoslavia

Export of Transformer Oil in January 2015

- Bahrain

- Bangladesh

- Brazil

- Indonesia

- Iran

- Korea

- Malaysia

- Morocco

- Nepal

- New Zealand

- Nigeria

- Oman

- Paraguay

- Peru

- South Africa

- Saudi Arabia

- Singapore

- Syria

- Tanzania

- Thailand

- UAE

- Vietnam