Base Oil Report

India’s oil imports from Iran fell 41.5% in October from a year ago to the lowest in seven months, as state-run refiner MRPL cut imports due to a maintenance shutdown. India, Iran’s top customer after China, took 181,200 barrels per day (bpd) oil from Tehran in October, down 22.3% from September. Mangalore Refinery and Petrochemicals Ltd (MRPL), which operates a 300,000-barrels-per-day (bpd) coastal refinery in southern India, is a key Indian oil client of Iran. The refiner had shut nearly 46% of its crude processing capacity for about a month from 18 September for planned maintenance. MRPL planned fewer purchases of Iran oil for last month as its biggest crude distillation unit (CDU) was shut. While MRPL received about 45,000 bpd Iranian oil in October, private refiner Essar Oil took about 136,300 bpd. India, the world’s fourth-biggest oil consumer, bought 21.8% less Iranian crude for the January-October period at about 212,600 bpd. India’s imports from Iran for the year-to-date have been dragged down by deep cuts in shipments by New Delhi in the first quarter of 2015, under pressure from the United States to keep its imports within the limits of sanctions targeting Tehran’s disputed nuclear programme. In the first seven months of India’s fiscal year, running from April through October, its oil imports from Iran jumped 5.6% to 249,100 bpd as refiners raised purchases after the July deal that may mean the removal of sanctions next year.

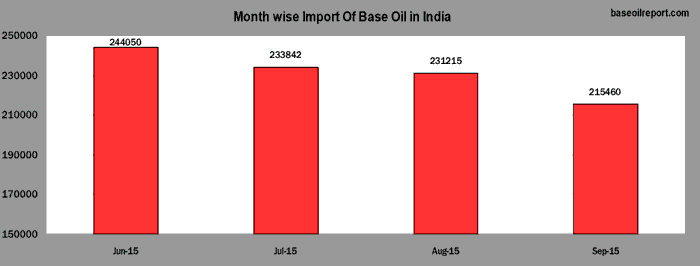

During the period June 2015 to September 2015, India imported 924568 MT of Base Oil. The country imported 244050 MT in June, 233842 MT in July, 231215 MT in August and 215460 MT in September 2015. Compared to the previous month i.e. August 2015 Base Oil import of the country has decreased by 7% in September 2015. Compared to the same month last year i.e. September 2014, Base Oil import has gone up by 5% in September 2015.

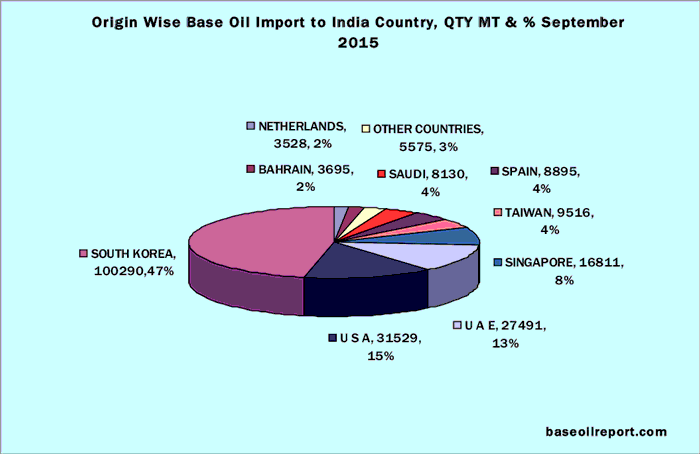

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of September 2015, approximately 215460 MT have been procured at Indian Ports of all the grades, which is 7% down as compared to August 2015, Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL/BPCL basic prices for SN – 70/N – 70/SN – 150/N -150 marked down by Rs. 1.50 per liter, while SN - 500/N - 500 down by Rs. 4.70 per liter. Bright Stock price was also marginally down by Rs. 1.00 per liter. The prices are effective November 02, 2015.Hefty Discounts are also offered by refiners for lifting sizeable quantity. Prices for the second half of the current month remains unchanged. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 33.25 – 33.55/34.00 – 34.10 per liter, excise duty and VAT as applicable ex Silvassa in bulk for one tanker load. Further reduction in prices is not ruled out. At current level availability is not a concern.

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level have been marginally up. As per conversation with domestic importers and traders prices reflects minimal changes for N – 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 34.10 – 34.25/35.10 – 35.50/36.40 – 36.75 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered exSilvassa a tax free zone. Discounts are offered for lifting sizeable quantity. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.35 – 0.45 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 35.70 – 35.80 per liter in bulk and Heavy Liquid paraffin (IP) is Rs.39.10 – 39.25 per liter in bulk respectively plus taxes extra.

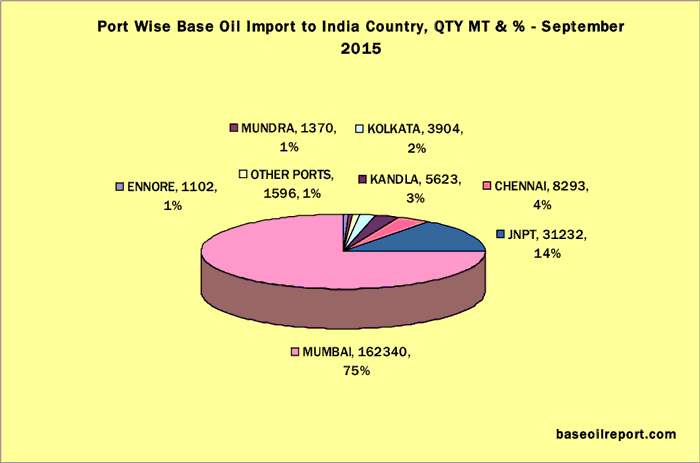

During the month of September 2015, India imported 215460 MT of Base Oil. While India imported the huge quantum in small shipments on different ports.

Approximately 11382 MT of Light & Heavy White Oil has been exported in the month of September 2015 from Chennai, JNPT, and Village Ponneri and Raxaul. Compared to August 2015; exports of the country have gone up by 20% in the month of September 2015.

Approximately 2860 MT of Transformer Oil has been exported in the month of September 2015 from JNPT, Chennai and Village Ponneri from refiners, suppliers, buyers, traders, agents, consultants, lubricant companies, professionals and logistic providers as well as any other entities of the base oil value chain. Base Oil Report is a comprehensive marketplace for global base oil reporting and trading.

Our subscribers can use this exclusive and unique base oil gateway to access information from the different sections and post and reply to international base oil offers. The gateway offers integrated solutions and is an essential tool for members that want to enhance their trading opportunities and access timely base oil news, prices and analysis.

Dhiren Shah Dhiren Shah is a Chemical Engineer and Editor–in–Chief of Petrosil Group, who started his career with a reputed transformer oil manufacturing company in India as Sales Engineer and enhanced his knowledge by undergoing a business management course at the Indian Merchants Chamber. He later ventured and specialized in imports and logistics of petroleum products for 10 years and in 2002 became part of the Petrosil Group. He is instrumental in developing the various Petrosil brands. He loves to read and travel and is also an avid internet surfer.

| Month | Group I–SN 150 Iran Origin | N-500 Korean Origin | J- 500 Singapore | Napthenic Base Oil HYGOLD L2000 |

|---|---|---|---|---|

| September 2015 | 510–515 | 635–650 | 625–635 | 605–625 |

| October 2015 | 490–495 | 615–620 | 605–615 | 585–605 |

| November 2015 | 450–455 | 575–580 | 565–575 | 545–565 |

| Since September 2015, prices have gone down by 60 PMT (12%) in November 2015. | Since September 2015, prices have decreased by 65 PMT (10%) in November 2015. | Since September 2015, prices have marked down by 60 PMT (10%) in November 2015. | Since September 2015, prices have dipped down by 60 PMT (10%) in November 2015. |

Approximately 11382 MT of Light & Heavy White Oil has been exported in the month of September 2015 from Chennai, JNPT, and Village Ponneri and Raxaul. Compared to August 2015; exports of the country have gone up by 20% in the month of September 2015.

Export of Light & Heavy White Oil

- Argentina

- Columbia

- Greece

- Kenya

- Pakistan

- South Africa

- UAE

- Australia

- Cuba

- Indonesia

- Latvia

- Peru

- Spain

- UK

- Bahrain

- Djibouti

- Iran

- Malaysia

- Philippines

- Sri Lanka

- USA

- Bangladesh

- Dominican Re

- Iraq

- Morocco

- Poland

- Sudan

- Ukraine

- Brazil

- Ecuador

- Israel

- Myanmar

- Russia

- Taiwan

- Uruguay

- Bulgaria

- Egypt

- Italy

- Nepal

- Saudi Arabia

- Tanzania

- Vietnam

- China

- Guatemala

- Ivory Coast

- Netherlands

- Senegal

- Thailand

- Zaire

- Costa Rica

- Germany

- Japan

- New Zealand

- Sierra Leone

- Tunisia

- Chile

- Ghana

- Jordan

- Nigeria

- Singapore

- Turkey

Approximately 11382 MT of Light & Heavy White Oil has been exported in the month of September 2015 from Chennai, JNPT, and Village Ponneri and Raxaul. Compared to August 2015; exports of the country have gone up by 20% in the month of September 2015.

Export of Transformer Oil in January 2015

- Bangladesh

- Indonesia

- Morocco

- Oman

- Sri Lanka

- UAE

- Brazil

- Iran

- Nepal

- Paraguay

- Saudi Arabia

- Tanzania

- Uruguay

- Djibouti

- South Korea

- Nigeria

- Peru

- Singapore

- Thailand

- Vietnam

- Ghana

- Kenya

- New Zealand

- Philippines

- South Africa

- Turkey

Approximately 2860 MT of Transformer Oil has been exported in the month of September 2015 from JNPT, Chennai and Village Ponneri.