Base Oil Report

Weak Chinese factory output and an increase in crude oil production from Saudi Arabia weighed down crude oil prices in early Monday trading. West Texas Intermediate, the U.S. benchmark price for crude oil, was off by a fraction of a percent from the previous close to trade at $44.47 per barrel before the start of trading in New York. Brent crude oil lost 1.1 percent from the previous session to fall to $47.59 per barrel. A string of bad economic news from China has put downward pressure on crude oil prices, pushing Brent down nearly 4 percent from Sept. 1. The Organization of Petroleum Exporting Countries said in its September market report Chinese economic growth expectations were revised downward by 0.1 percent to 6.8 percent in 2015 and 6.4 percent in 2016. OPEC said this could spill over into the European economy. Weak economic momentum and high supplies are keeping crude oil prices lower. Nevertheless, OPEC said demand for oil should improve next year.

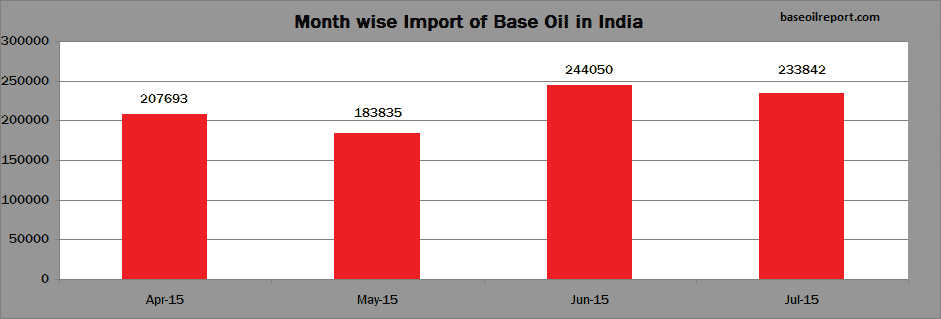

During the period April 2015 to July 2015, India imported 869420 MT of Base Oil. The country imported 207693 MT in April, 183835 MT in May, 244050 MT in June and 233842 MT in July 2015. Compared to the previous month i.e. June 2015 Base Oil import of the country has decreased by 4% in July 2015. Compared to the same month last year i.e. July 2014, Base Oil import was gone up by 6% in July 2015.

| Month Group I - SN 500 Iran Origin | N-70 Korean Origin | J-150 Singapore Origin | Bright Stock Europe Origin | |

|---|---|---|---|---|

| July 2015 | 640 – 650 | 665 – 670 | 715 – 725 | 945 – 955 |

| August 2015 | 615 – 625 | 640 – 645 | 690 – 695 | 920 – 930 |

| September 2015 | 525 – 535 | 590 – 595 | 620 – 625 | 870 – 880 |

| Since July 2015, prices have gone down by USD 115 PMT (18%) in September 2015. | Since July 2015, prices have decreased by USD 75 PMT (11%) in September 2015. | Since July 2015, prices have marked down by USD 95 PMT (13%) in September 2015. | Since July 2015, prices have dipped down by USD 75 PMT (8%) in September 2015. |

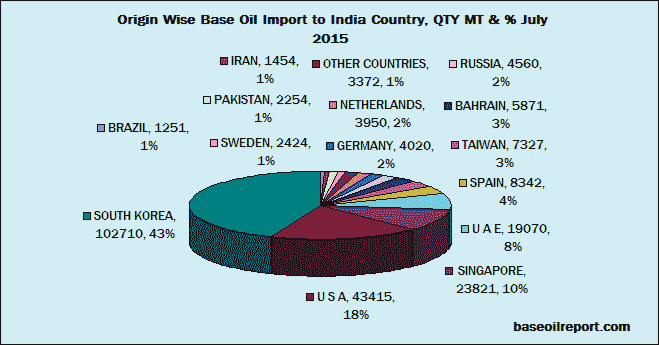

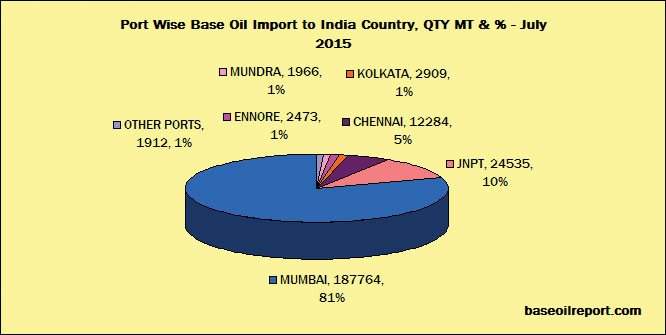

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of July 2015, approximately 233842 MT have been procured at Indian Ports of all the grades, which is 4% down as compared to June 2015, Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL/BPCL basic prices for SN – 70/N – 70/SN – 150/N -150 marked down by Rs. 0.10 per liter, while SN - 500/N - 500 is decreased by Rs.0.60 per liter. Bright Stock price is down by Rs. 2.60 per liter. The prices are effective September 01, 2015. Hefty Discounts are also offered by refiners for lifting sizeable quantity. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 41.75 – 41.85/42.20 – 42.30 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level have been marginally up. As per conversation with domestic importers and traders prices reflects minimal changes for N – 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 41.50 – 41.80/41.70 – 41.90/44.20 – 44.40 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered ExSilvassa a tax free zone. Discounts are offered for lifting sizeable quantity. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.35 – 0.45 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 41.75 – 42.05 per liter in bulk and Heavy Liquid paraffin (IP) is Rs.45.90 – 46.30 per liter in bulk respectively plus taxes extra.

Petrosil Base Oil Report (www. baseoilreport.com) offers solutions to the entire base oil value chain, from refiners, suppliers, buyers, traders, agents, consultants, lubricant companies, professionals and logistic providers as well as any other entity of the base oil value chain. Base Oil Report is a comprehensive marketplace for global base oil reporting and trading

Export of Light & Heavy White Oil

- Algeria

- China

- Haiti

- Japan

- Nigeria

- Russia

- Australia

- Columbia

- Indonesia

- Kenya

- Pakistan

- Saudi Arabia

- Bangladesh

- Djibouti

- Iran

- Latvia

- Peru

- Senegal

- Belgium

- Egypt

- Iraq

- Malaysia

- Philippines

- Sierra Leone

- Brazil

- Germany

- Israel

- Myanmar

- Poland

- Singapore

- Bulgaria

- Ghana

- Italy

- Nepal

- Puerto Rico

- South Africa

- Cameroon

- Greece

- Ivory Coast

- Netherlands

- Romania

- Spain

- Sri Lanka

- Sweden

- Tanzania

- Thailand

- Togo

- Tunisia

- Turkey

- UAE

- UK

- USA

- Ukraine

- Uruguay

- Vietnam

- Yemen

Approximately 8723 MT of Light & Heavy White Oil has been exported in the month of July 2015 Compared to the month of June 2015; exports of the country have gone up by 34% in the month of July 2015.

Export of Transformer Oil in January 2015

- Algeria

- China

- Indonesia

- Morocco

- Paraguay

- Australia

- Djibouti

- Iran

- Nepal

- Peru

- Saudi Arabia

- Bangladesh

- Egypt

- Israel

- New Zealand

- Philippines

- Singapore

- Brazil

- Ghana

- South Korea

- Oman

- South Africa

- Sri lanka

- Thailand

- UAE

- UK

- Vietnam

- Zaire

- Zimbabwe

Approximately 5824 MT of Transformer Oil has been exported in the month of July 2015.

About The Author

Dhiren Shah is a Chemical Engineer and Editor-in-Chief of Petrosil Group. He is instrumental in developing the various Petrosil brands.