Base Oil Report

With price of Brent crude already hitting a 11-year low, any upward movement in the price looks unlikely in the coming quarters as the Organization of the Petroleum Exporting Countries (Opec) refused to restrain its production. As oil analysts believe that the recent hike in interest rate by the US Fed and OPEC decision in its last meeting not to put a cap on its production will create a scenario of oversupply and weakening demand. International Energy Agency has warned that global oversupply could worsen in 2016. Also, OPEC production has moved up from 30 million barrels per day (bpd) to 31 million bpd. Of them, Saudi Arabia, the largest producer, had registered an output of 9.7 million bpd. The outlook for crude oil remains bleak. With the crude oil from Iran coming into the market, prices can further ease in a month’s time. The short term looks like the WTI crude will touch $30-32 per barrel and will hover around for a while. However, analysts believe that every crude oil producing country seems to be concerned about cash flows and their own fiscal deficit and no one has cut production due to falling prices. Between June and October, a surplus of 2.1 million barrels has already been recorded. Part of the weakness is also due to currency fluctuations.

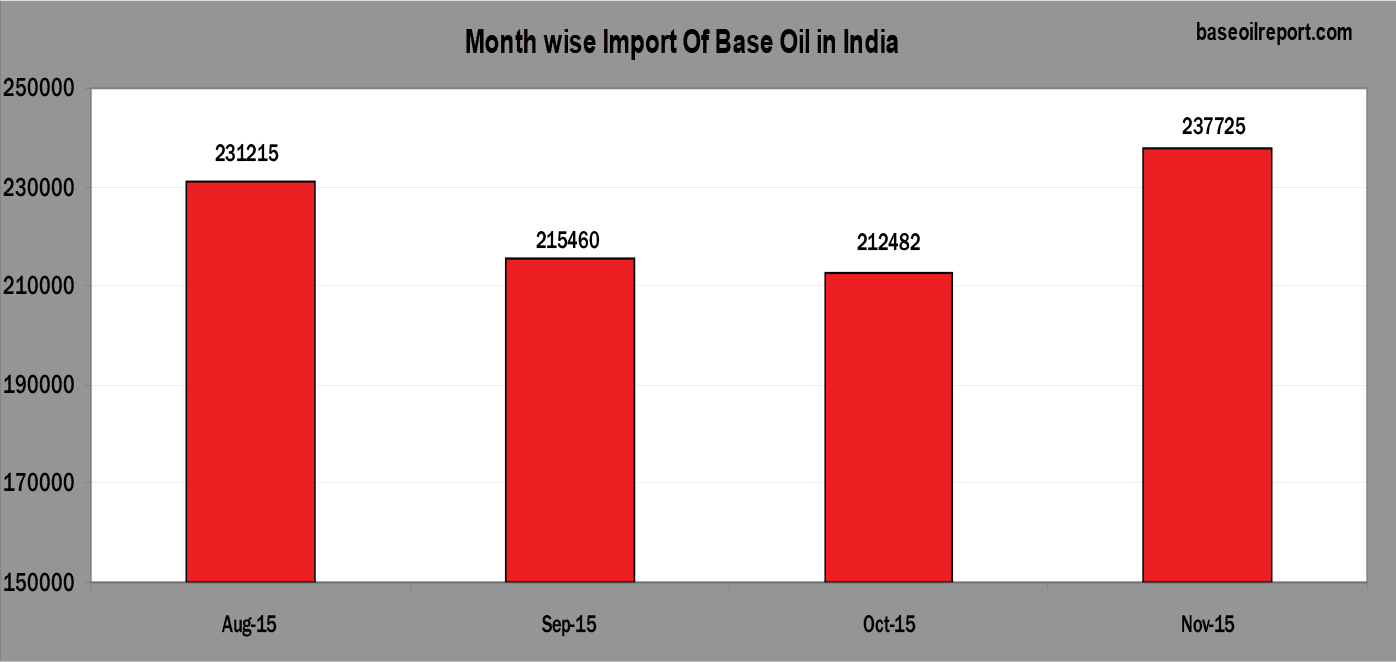

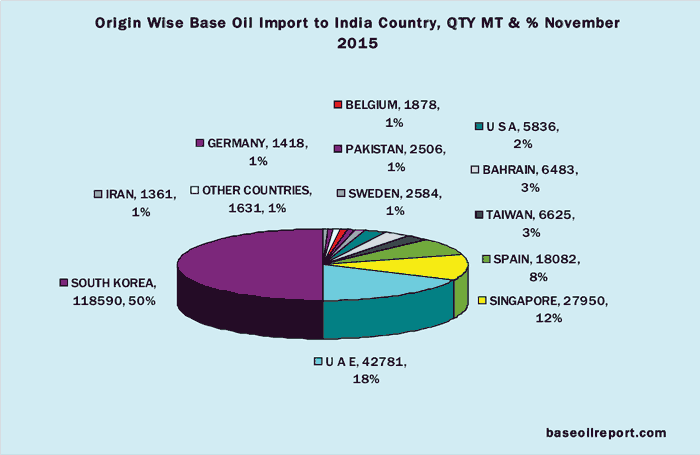

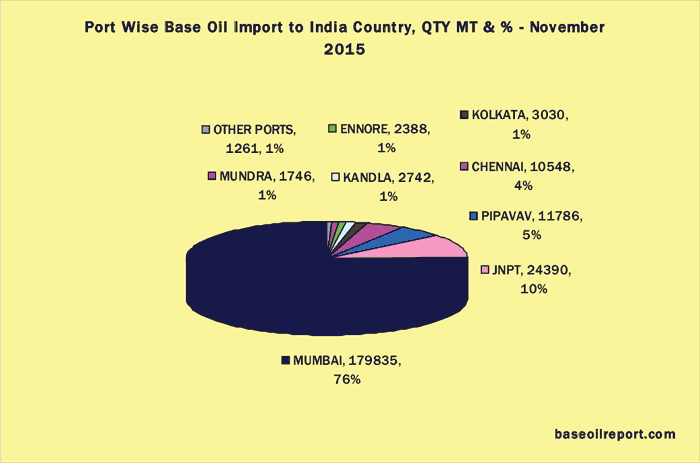

During the period August 2015 to November 2015, India imported 924568 MT of Base Oil. The country imported 231215 MT in August, 215,460 MT in September, 212,482 MT in October and 237725 MT in November 2015. Compared to the previous month i.e. October 2015 Base Oil import of the country has surged up by 12% in November 2015. Compared to the same month last year.

| Month | Group I-SN 500 | N-70 Korean | J-150 Singapore | Bright Stock-150 |

|---|---|---|---|---|

| October 2015 | 505 – 515 | 570 – 575 | 600 – 605 | 850 – 860 |

| November 2015 | 465 – 475 | 525 – 530 | 560 – 565 | 810 – 820 |

| December 2015 | 475 – 480 | 510 – 515 | 535 – 545 | 810 – 820 |

| Since October 2015, prices have dripped down by USD 30 PMT (6%) in December 2015. | Since October 2015, prices have marked down by USD 60 PMT (10%) in December 2015. | Since October 2015, prices have dipped down by USD 60 PMT (10%) in December 2015. | Since October 2015, prices have fallen down by USD 40 PMT (5%) in December 2015. |

The Indian domestic market Korean origin Group II plus N-6070/150/500 prices at the current level have been marginally down. As per conversation with domestic importers and traders prices reflects minimal changes for N 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 31.25 31. 30/32.25 32.35/34.30 35.35 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/ Vat if products are offered Ex-Silvassa a tax free zone. Discounts are offered for lifting sizeable quantity. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.35 0.45 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 33.10 33.20 per liter in bulk and Heavy Liquid paraffin (IP) is Rs.37.00 37.15 per liter in bulk respectively plus taxes extra. Approximately 10141 MT of Light & Heavy White Oil has been exported in the month of November 2015 from Chennai, JNPT, Mundra and Ahmedabad. Compared to last month i.e. October 2015; exports of the country have gone down by 3% in the month of November 2015.

Export of Light & Heavy White Oil

- Argentina

- Columbia

- Greece

- Kenya

- Pakistan

- South Africa

- UAE

- Australia

- Cuba

- Indonesia

- Latvia

- Peru

- Spain

- UK

- Bahrain

- Djibouti

- Iran

- Malaysia

- Philippines

- Sri Lanka

- USA

- Bangladesh

- Dominican Re

- Iraq

- Morocco

- Poland

- Sudan

- Ukraine

- Brazil

- Ecuador

- Israel

- Myanmar

- Russia

- Taiwan

- Uruguay

- Bulgaria

- Egypt

- Italy

- Nepal

- Saudi Arabia

- Tanzania

- Vietnam

- China

- Guatemala

- Ivory Coast

- Netherlands

- Senegal

- Thailand

- Zaire

- Costa Rica

- Germany

- Japan

- New Zealand

- Sierra Leone

- Tunisia

- Chile

- Ghana

- Jordan

- Nigeria

- Singapore

- Turkey

Approximately 10,141 MT of Light & Heavy White Oil has been exported in the month of November 2015 from Chennai, JNPT, Mundra and Ahmedabad. Compared to last month i.e. October 2015; exports of the country have gone down by 3% in the month of November 2015.

Export of Transformer Oil in January 2015

- Bangladesh

- Indonesia

- Morocco

- Oman

- South Africa

- Sri Lanka

- UAE

- Brazil

- Iran

- Nepal

- Paraguay

- Saudi Arabia

- Tanzania

- Uruguay

- Djibouti

- South Korea

- Nigeria

- Peru

- Singapore

- Thailand

- Vietnam

- Ghana

- Kenya

- New Zealand

- Philippines

- Turkey

Approximately 2,923 MT of Transformer Oil has been exported in the month of November 2015.

Petrosil Base Oil Report (www.baseoilreport.com) offers solutions to the entire base oil value chain, from refiners, suppliers, buyers, traders, agents, consultants, lubricant companies, professionals and logistic providers as well as any other entity of the base oil value chain. Base Oil Report is a comprehensive marketplace for global base oil reporting and trading.

Our subscribers can use this exclusive and unique base oil gateway to access information from the different sections and post and reply to international base oil offers. The gateway offers integrated solutions and is an essential tool for members that want to enhance their trading opportunities and access timely base oil news, prices and analysis.