Base Oil Report

The crude which was trading around $50/bbl at the beginning of year 2017 climbed to $68/ bbl in the frst week of January 2018, resulting in a rally of over 20 percent in the crude oil prices in the last one year. Higher oil prices do pose a concern for fuel importing countries like India which would have an adverse impact on the economy as well as companies which used crude as part of the raw material in their product. The rise in global crude prices is backed by output cut by OPEC & Russia, freezing weather in the US which has fuelled demand for heating oil. Strong economic data from major economies and falling crude oil inventories coupled with Middle East tensions will keep the commodity on trader’s radar.

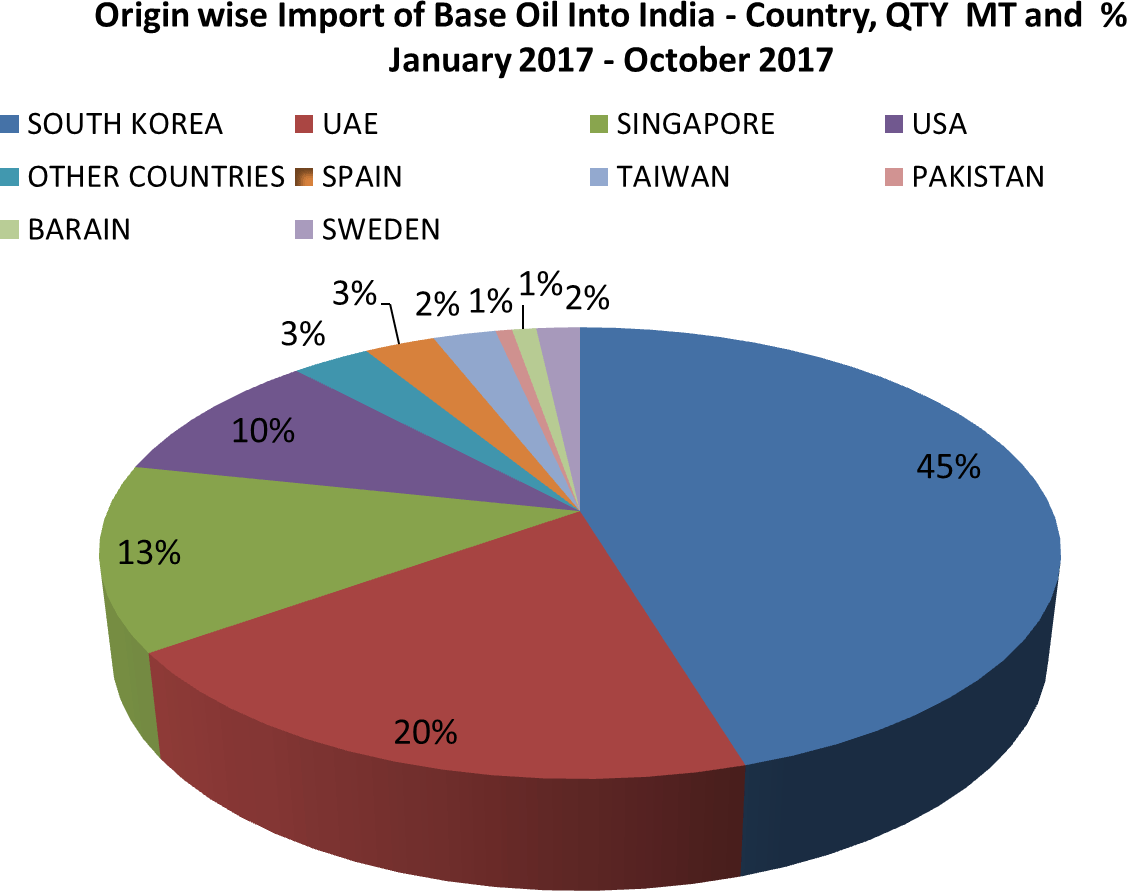

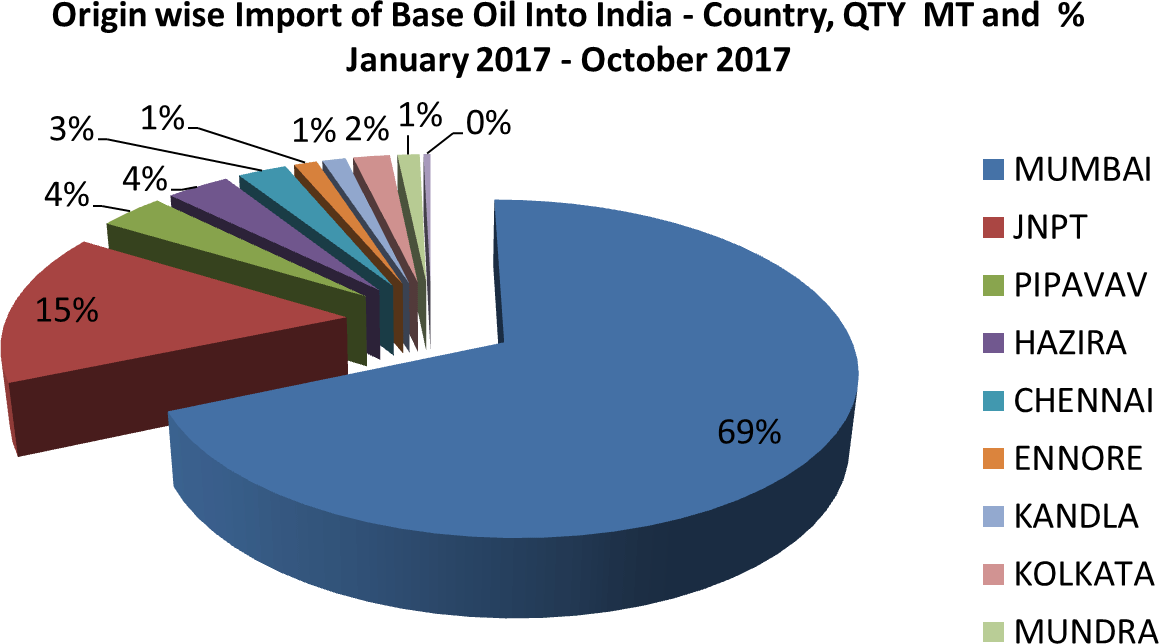

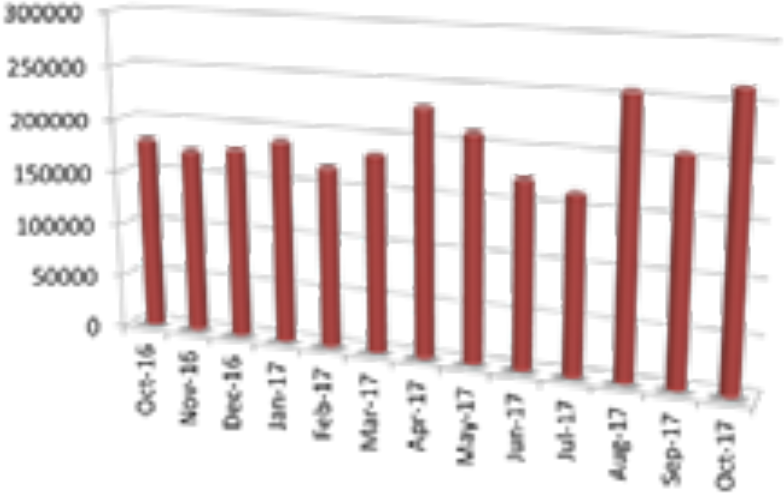

Import of the country has fall down by 6% during Jan to October 2017, as compared to the same period last year i.e. Jan to October 2016. Dhiren Shah (Editor – In – Chief of Petrosil Group) Petrosil Base Oil Report offers solutions to the entire base oil value chain, from refners, suppliers, buyers, traders, agents, consultants, lubricant companies, professionals and logistic providers as well as any other entity of the base oil value chain.

| Month | Group I–SN 150 Iran Origin | Group II -J-500 Singapore Origin | N- 70 South Korea Origin | Bright Stock USA Origin |

|---|---|---|---|---|

| October 2017 | USD 670–785 | 735–750 | 680–690 | 1090–1110 PMT |

| November 2017 | USD 690–705 | 755–770 | 700–710 | 1110–1130 PMT |

| December 2017 | USD 690–705 | 755–770 | 700–710 | 1110–1130 PMT |

| Since October 2017, prices have gone up in December 2017 by | USD 20 PMT (3%) | USD 20 PMT (3%) | USD 20 PMT (3%) | USD 20 PMT (2%) |