Base Oil Report

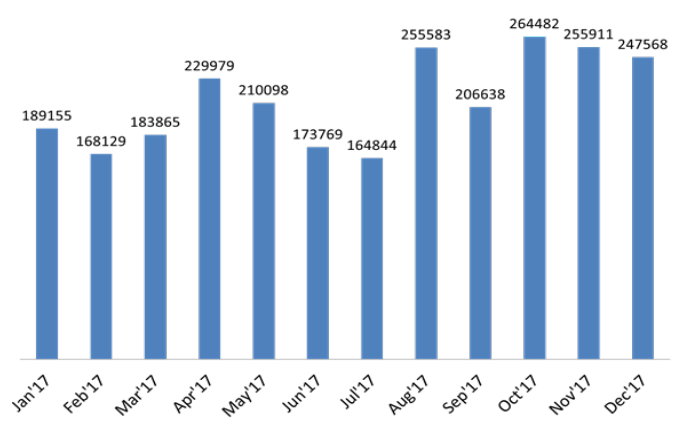

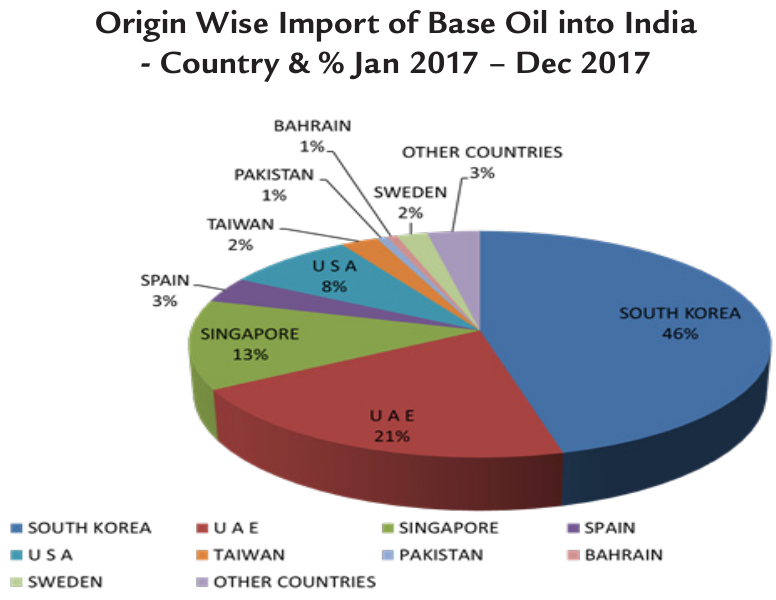

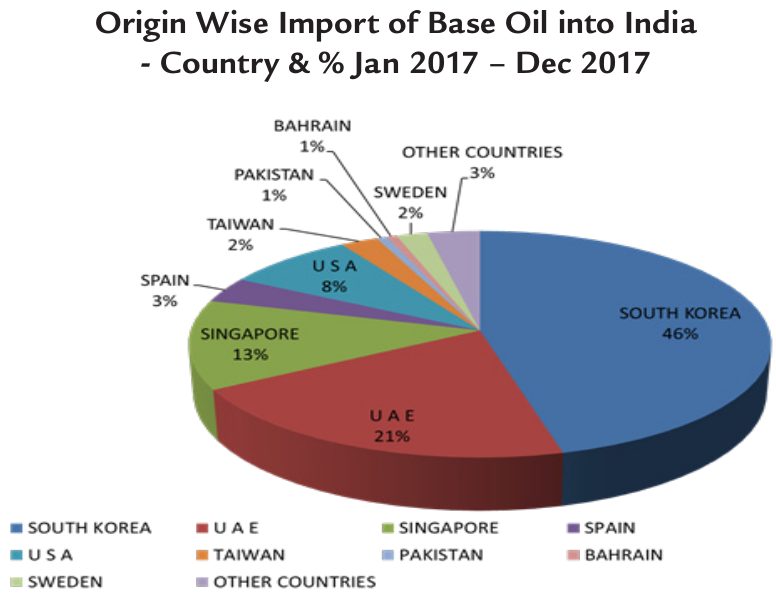

Oil prices rose sharply on third week of March 2018, with Brent futures settling at their highest level in two weeks as traders focused on rising geopolitical risks in the Middle East, while gains in U.S. equity markets also boosted crude prices. U.S. West Texas Intermediate (WTI) crude futures for April delivery surged 1.88% to close at $62.41 a barrel. Meanwhile, Brent crude futures, the benchmark for oil prices outside the U.S., jumped $1.01 or 1.55% to settle at $66.13 a barrel. It was the highest settlement since February 28. For the week, WTI crude rose 0.48%, while Brent gained 1.1%. Oil prices rose amid speculation over the fate of Iran’s nuclear deal, which allowed Tehran to boost oil production, in the wake of the fring of U.S. Secretary of State Rex Tillerson. Oil prices also remained supported after a report from the International Energy Agency on Thursday showed that supply from the Organization of the Petroleum Exporting Countries moderated in February on a drop in production from Venezuela. Import of the country has hike up by 1% during Jan to December 2017, as compared to the same period last year i.e. Jan to December 2016. The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades.

Oil prices rose sharply on third week of March 2018, with Brent futures settling at their highest level in two weeks as traders focused on rising geopolitical risks in the Middle East, while gains in U.S. equity markets also boosted crude prices. U.S. West Texas Intermediate (WTI) crude futures for April delivery surged 1.88% to close at $62.41 a barrel. Meanwhile, Brent crude futures, the benchmark for oil prices outside the U.S., jumped $1.01 or 1.55% to settle at $66.13 a barrel. It was the highest settlement since February 28. For the week, WTI crude rose 0.48%, while Brent gained 1.1%. Oil prices rose amid speculation over the fate of Iran’s nuclear deal, which allowed Tehran to boost oil production, in the wake of the fring of U.S. Secretary of State Rex Tillerson. Oil prices also remained supported after a report from the International Energy Agency on Thursday showed that supply from the Organization of the Petroleum Exporting Countries moderated in February on a drop in production from Venezuela. Import of the country has hike up by 1% during Jan to December 2017, as compared to the same period last year i.e. Jan to December 2016. The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades.

| Month | Group I–SN 500 Iran | Group II–J-150 Singapore | N- 70 South Korea | Napthenic Base Oil HYGOLD L500 |

|---|---|---|---|---|

| January 2018 | 760–765 | 735–745 | 705–715 | 760–770 |

| February 2018 | 790–795 | 765–775 | 735–745 | 770–785 |

| March 2018 | 805–815 | 780–795 | 745–755 | 765–780 |

| Since January 2018, prices have gone up by in March 2018 | USD 45 PMT (6%) | USD 45 PMT (6%) | USD 40 PMT (6%) | USD 10 PMT (1%) |