Base Oil Report

India ll imports in October rose 14.1 percent from a year earlier to 4.7 million barrels per day (bpd) with shipments from Africa more than doubling to 874,000 bpd. The reason behind this rise is due to higher fuel demand in the festival season and as industrial activity picks up after four months of monsoon rains. Resumption of operations at some refinery units after maintenance turnaround also pushed up India's oil imports in October. A narrowing price differential between Brent and Dubai linked grades and uncertainties over Iranian supplies were another reason that spurred the purchase of African grades. The narrowing of the price spread between the two benchmarks opens the arbitrage for Atlantic Basin crude grades to Asia, while making Dubai linked grades more expensive for Asian buyers.

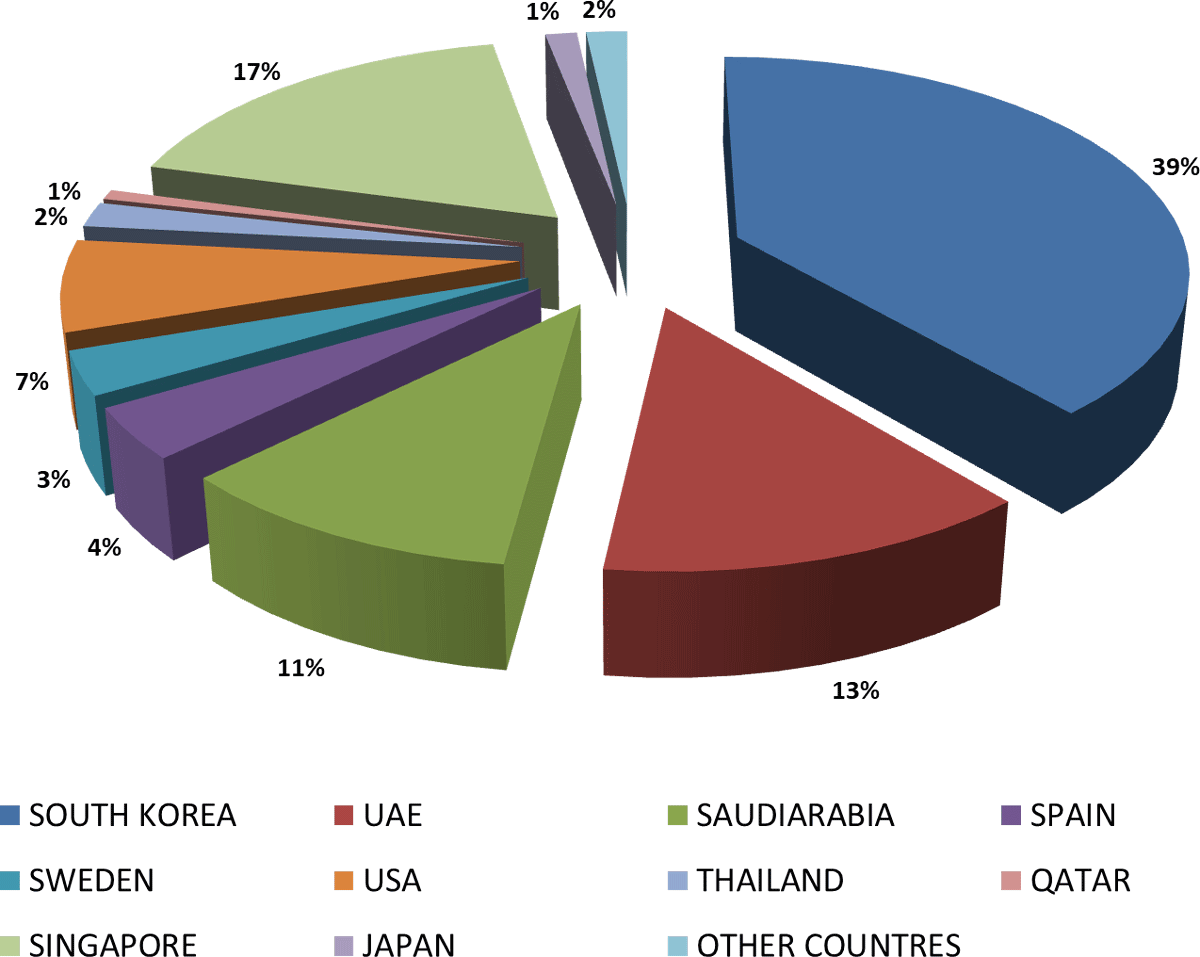

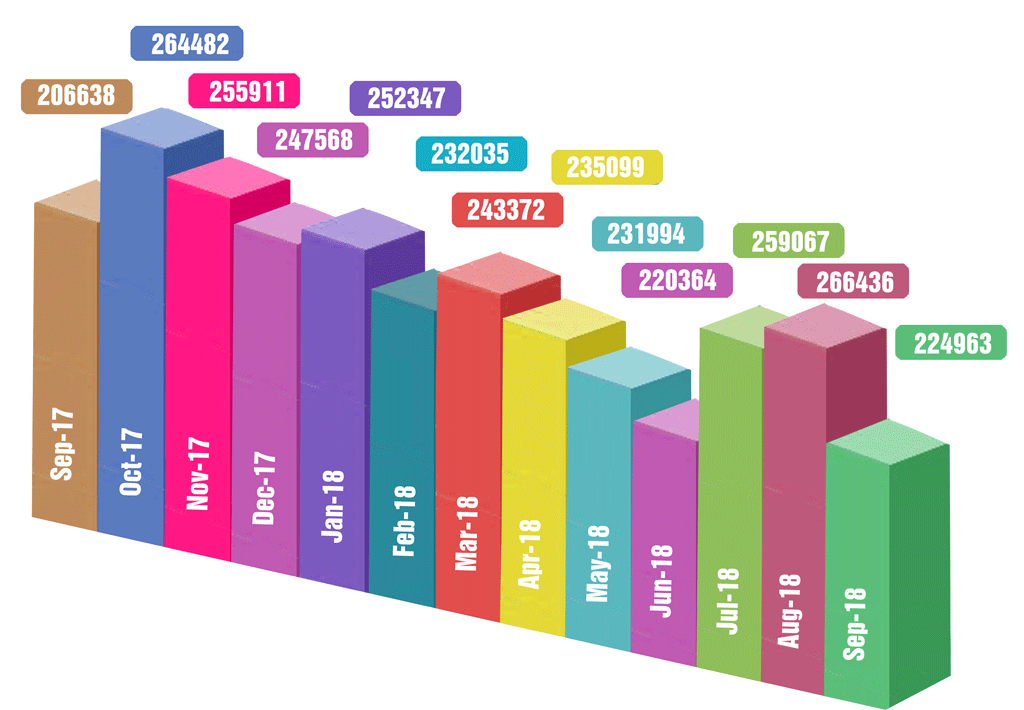

India import has gone up by 9% in September 2018, as compared to same period last year i.e. September 2017. The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of September 2018, approximately 224963 MT have been procured at Indian Ports of all the grades. Compared to last month i.e. August 2018, import of the country has decreased by 16% in the month of September 2018. Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL/BPCL has changed their base oil numbers as reflected in the price chart effective November 01, 2018.

In the month of September 2018, India imported 66436 MT of Base Oil, India imported the huge quantum in small shipments on different ports like 109548 MT (49%) into Mumbai, 31067 MT (14%) into Chennai, 23012 MT (10%) into JNPT, 17195 MT (8%) into Kolkata, 14869 MT (7%) into Hazira, 13008 MT (6%) into Pipavav, 11950 MT (2%) into Kandla, 3457 MT (2%) into Mundra and 857 MT into Other Ports.

| Month | Group I-SN 500 Iran Origin | Group II-N 250 Korea Origin | N-70 South Korea Origin | Rubber Process Oil Drums Iran Origin (Aromatic Extract) |

|---|---|---|---|---|

| September 2018 | 835 – 845 | 810 – 820 | 770 – 780 | 420 – 430 |

| October 2018 | 830 – 840 | 805 – 815 | 765 – 775 | 420 – 430 |

| November 2018 | 810 – 820 | 785 – 795 | 745 – 755 | 415 – 425 |

| Between Sep-Nov 2018, prices have gone down by | USD 25 PMT (3%) | USD 35 PMT (5%) | USD 25 PMT (3%) | USD 5 PMT (1%) |