Base Oil Report

India’s crude oil imports from Iran, which have been on a decline since November last year on the back of fresh US sanctions, suffered a 6.5 per cent fall to 1.56 Million Tonne (MT) in January as against 1.6 MT reported in the same month last year. Overall, oil imports from Iran between April-January 2018-2019 rose 16.3 per cent to 21.32 MT, according to data sourced from the Directorate General of Commercial Intelligence and Statistics (DGCIS), an arm of the commerce ministry. India and Iran had on in November last year signed a bilateral agreement to settle oil trades through the state-owned UCO Bank in the Indian currency, which is not freely traded on international markets. Crude imports from Saudi Arabia – the de-facto leader of the Organization of Petroleum Exporting Countries (OPEC) and the second largest crude oil supplier to India -- have been on a steady increase this fscal year. Oil imports from that nation rose 12 per cent to 4.5 MT in January this year. Overall, oil imports from the Saudi nation have risen 13 per cent to 34 MT in the current fscal so far.

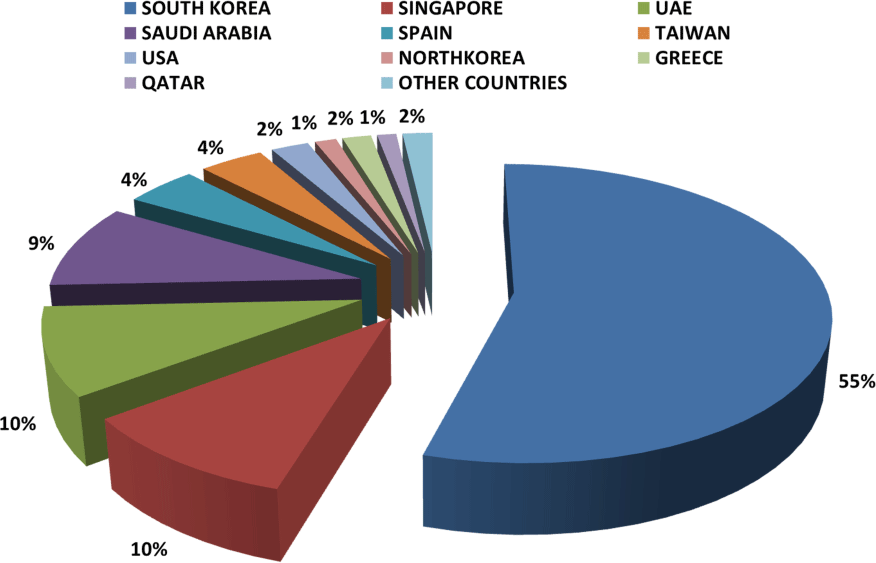

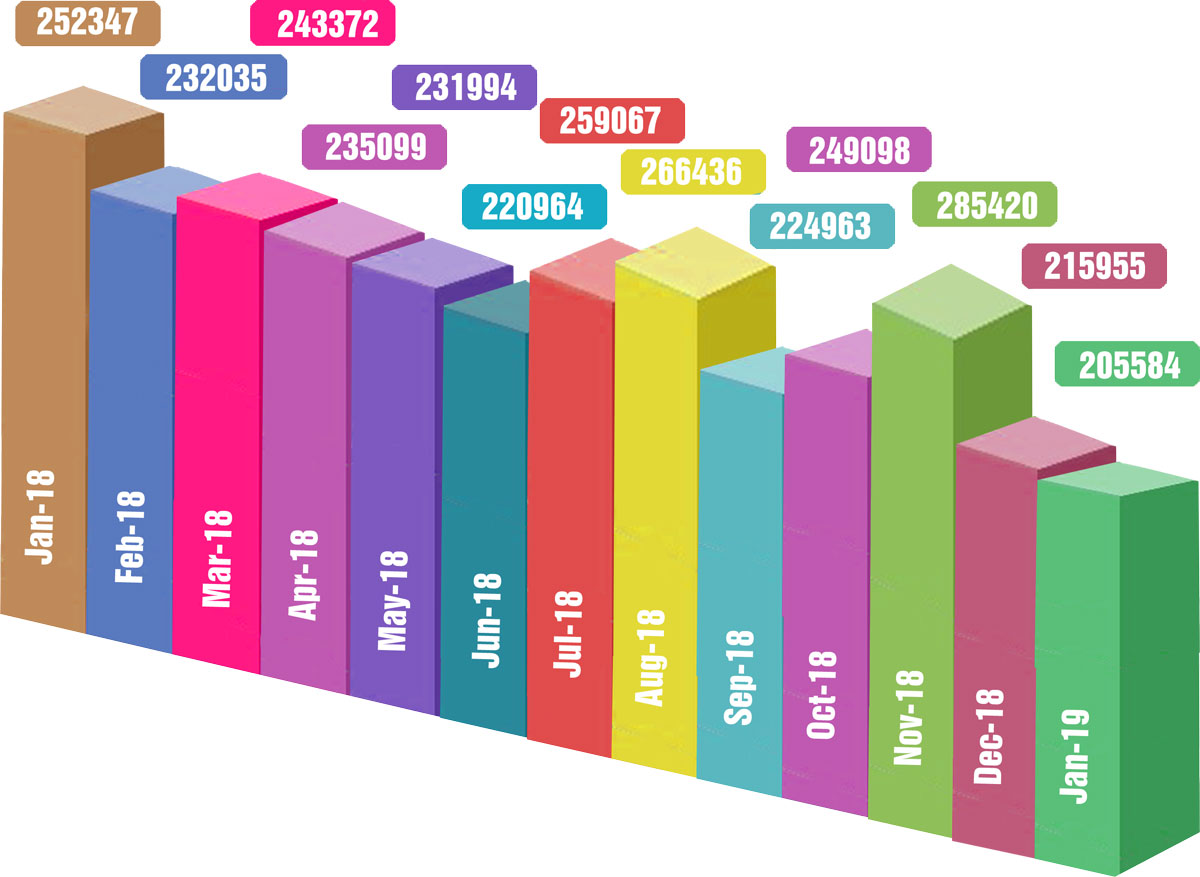

While in the month of January 2019, India imported 205584 MT of Base Oil, India imported the huge quantum in small shipments on different ports like 114572 MT (56%) into Mumbai, 28028 MT (14%) into JNPT, 26513 MT (13%) into Chennai, 13790 MT (7%) into Pipavav, 5971 MT (3%) into Hazira, 4940 MT (2%) into Kolkata, 4871 MT (2%) into Mundra, 4465 MT (2%) into Ennore, 2306 MT (1%) into Kandla and 129 MT into Other Ports.

| Month | Group I - SN 500 Iran Origin Base Oil CFR India Prices | Group II - N-150 Singapore Origin Base Oil CFR India Prices |

N-70 South Korea Origin Base Oil CFR India Prices | Naphthenic HYGOLD L 2000 US Origin Base Oil CFR India Prices |

|---|---|---|---|---|

| January 2019 | 655 – 665 | 740 – 750 | 680 – 690 | 740 – 750 |

| February 2019 | 665 – 675 | 695 – 705 | 665 – 675 | 725 – 735 |

| March 2019 USD | 655 – 665 | 685 – 695 | 655 – 665 | 715 – 725 |

| Since January 2019, prices in March 2019. | Have remained steady | Fallen down by USD 55 PMT (7%) | Reduced by USD 25 PMT (4%) | Reduced by USD 25 PMT (3%) |