Base Oil Report

Indian government is focusing on increased use of bio-fuels and raising domestic crude oil and gas production to reduce imports. India needs to bring down its oil import dependence from 77 per cent in 2013-14, to 67 per cent by 2022. But with consumption growing at a brisk pace and domestic output remaining stagnant, India's oil import dependence has risen from 82.9 per cent in 2017-18, to 83.7 per cent in 2018-19. For the current fiscal, it projected crude oil imports to rise to 233 million tones and foreign exchange spending on it to marginally increase to USD 112.7 billion.

Indian government is focusing on increased use of bio-fuels and raising domestic crude oil and gas production to reduce imports. India needs to bring down its oil import dependence from 77 per cent in 2013-14, to 67 per cent by 2022. But with consumption growing at a brisk pace and domestic output remaining stagnant, India's oil import dependence has risen from 82.9 per cent in 2017-18, to 83.7 per cent in 2018-19. For the current fiscal, it projected crude oil imports to rise to 233 million tones and foreign exchange spending on it to marginally increase to USD 112.7 billion.

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level is marginally up for lighter grades and heavier grades. As per conversation with domestic importers and traders prices for N – 70/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 41.55 – 42.10/42.55 – 43.05/48.50 – 48.90 per liter in bulk plus 18% GST as applicable. Discounts being offered for sizeable quantity. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.30 – 0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs.43.50 – 43.65 per liter in bulk and Heavy Liquid paraffin (IP) is Rs.50.60 – 50.75 per liter in bulk respectively plus GST as applicable.

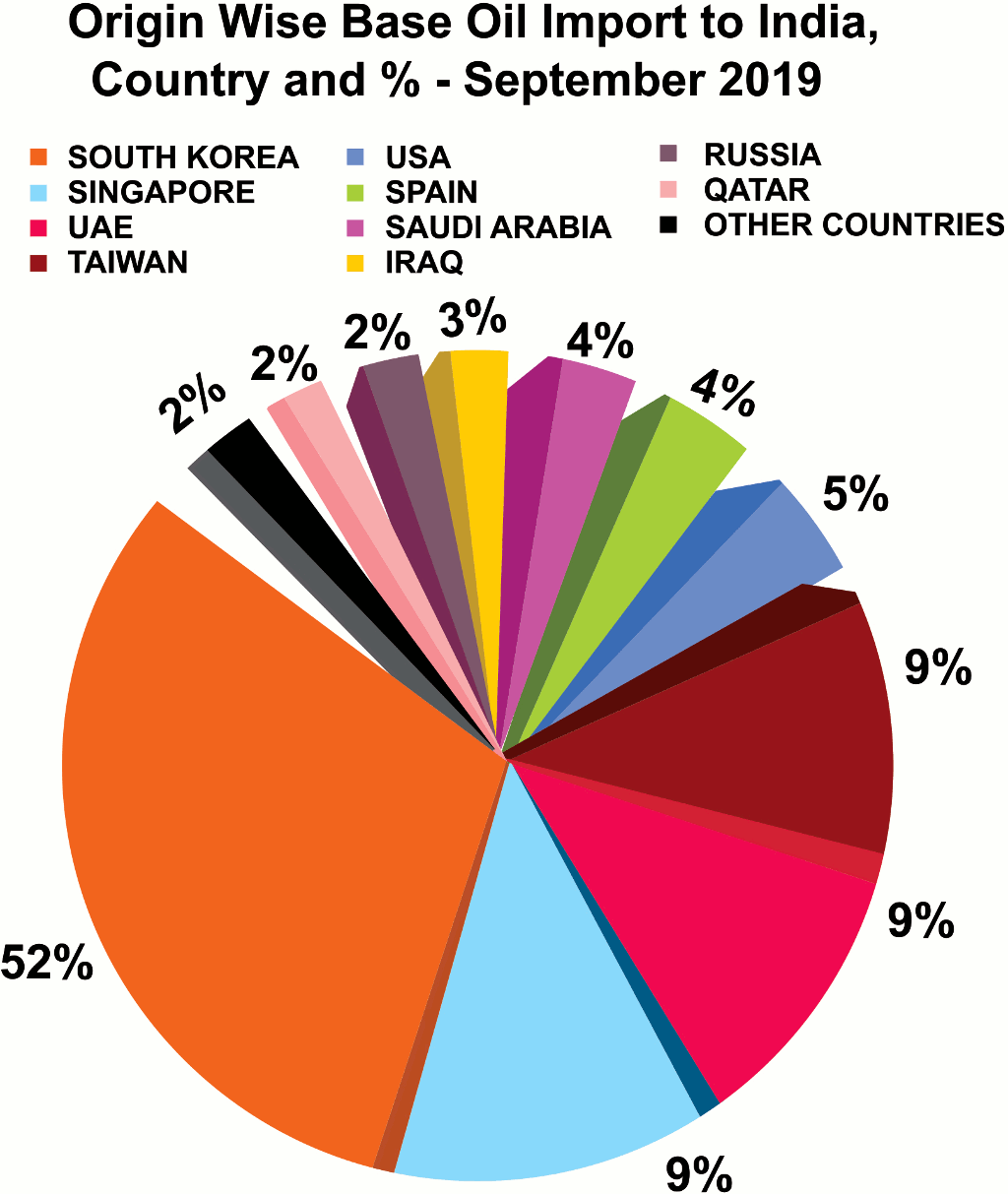

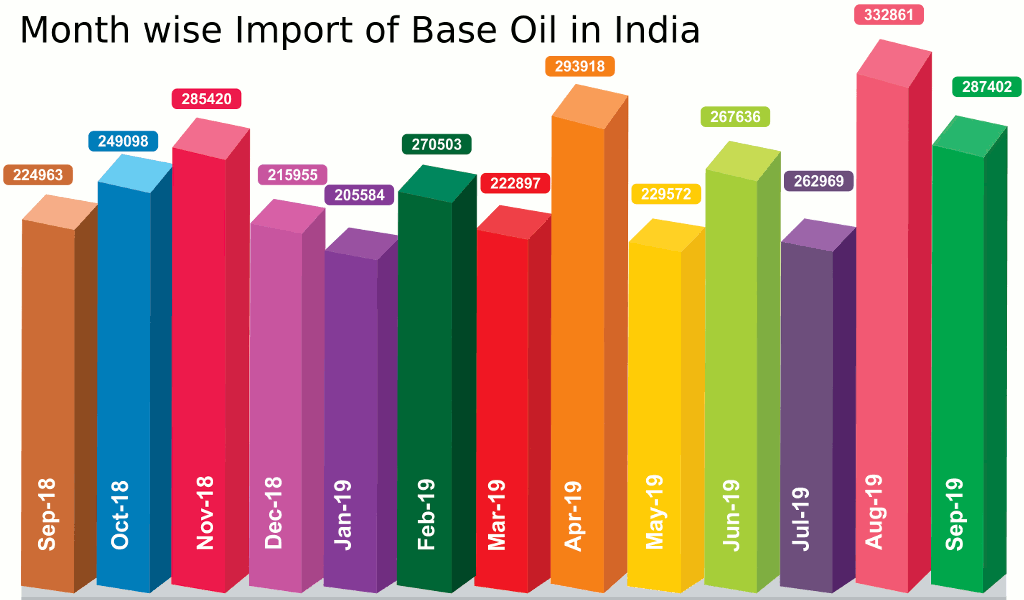

In the month of September 2019, India imported 287402 MT of Base Oil, India imported the huge quantum in small shipments on different ports like 179461 MT (62%) into Mumbai, 29210 MT (10%) into JNPT, 25579 MT (9%) into Chennai, 23530 MT (8%) into Pipavav, 11914 MT (4%) into Hazira, 9364 MT (3%) into Mundra, 5054 MT (2%) into Kandla, 2888 MT (1%) into Kolkata and 402 MT into Other Ports.

| Month | Group 1–SN 500 Iran Origin | Napthenic Base Oil HYGOLD L 500 US | N–70 South Korea Origin | Rubber Process Oil (Aromatic Extract) (Drums) Iran |

|---|---|---|---|---|

| September 2019 | 620–630 | 695–705 | 625–635 | 360–365 |

| October 2019 | 620–635 | 695–705 | 625–635 | 360–365 |

| November 201 9 | 605–615 | 680–690 | 610–620 | 345–350 |

| Since September 2019, prices have decrease by USD/PMT (%) in November 2019. | 15 (2%) | 15 (2%) | 15 (2%) | 15 (4%) |