Monitoring Lubricants in the Digital Era

Big data analytics, deep machine learning, artificial intelligence and the rise of the algorithm are driving the newest industrial revolution and have been for quite some time. The ability to capture data, create digital twins and autonomously alter, optimize and even control a machine’s performance from the other side of the world is now part of the fabric of many companies and industries. In short, everyone now strives to be “digital.”

However, for all this talk of digital and Industry 4.0, the manner in which industry monitors arguably the most critical part of any machine - it's the lifeblood, it's lubricating oil - still pre-dates this new digital movement and largely entails someone physically taking a sample of the oil, placing it in a plastic cup, handwriting the details of the oil and the machine, putting the sample in an envelope, sending it to a laboratory and waiting patiently (sometimes weeks) for a result showing the status of the oil at that small snapshot in time. Alternatively, a sample may be taken and tested locally using either a testing kit or a machine, giving a less exhaustive single snapshot.

This article will identify how the lubricant monitoring industry has started to change this paradigm as well as speculate where the industry is going and the potential it has to fully embrace Industry 4.0 and the digital revolution.

Data Is Useless

The push for “digital” relies heavily on the data that a system can ingest, and thus “data” has become very much in vogue. Now, there is almost an obsession with data, but by itself, data is completely useless. I personally own a well-known brand of fitness tracker watch. This fitness tracker has a wonderful feature that tracks my sleep. When I wake up, I almost obsessively check my phone, download the data and look at my sleep pattern. It can tell me how long I slept, whether I woke up during the night and even how deeply I slept over the course of the night. The analytics appear to be sound, and even the data is presented in a user-friendly manner. So, what does this data mean? What do I do with all this information? What changes do I make based on the data? What outcomes are derived from this sleep-tracking feature? None. Zip. Zero. It’s purely useless data.

Data falls into two categories: what can it tell me and what do I need to know? In this case, the data falls under the first category. Data that doesn’t drive outcomes is useless data.

For data to be meaningful, it must follow four rules: analysis, interpretation, context and outcome.

Analysis - The data must be fundamentally sound. Raw numbers do not provide meaning. The raw data must be turned into a useful output.

Interpretation - What does the data mean? How do the numbers relate to the reality of a situation?

Context - This element is largely ignored yet provides the most important insight. Context of the conditions surrounding the data can be as important as the data itself.

Outcome - This is another often ignored feature of data. As per the sleep tracker example, if data doesn’t drive a clear outcome, then it has no meaning.

Consider measuring a person’s weight. Let’s say a man weighs himself, and the (digital) scale shows that he is 184 pounds. Is this good? Is this a healthy weight? At this point, you only have an analysis. Without the other three elements, this data is useless.

For interpretation, let’s say you compare his weight to a weight/height chart. By this interpretation, 184 pounds for a man who is 6-foot-3 is a normal weight. This usually is where the data investigation ends, with analysis and interpretation, the correlation of single numbers versus specifications, and basic interpreted results. Green, yellow and red results are normal in the industry, especially in oil monitoring reports.

What’s missing are the context and outcome. Without context, you are assuming that someone who is 184 pounds and 6-foot-3 is healthy. Context comes in many forms, but the most common is trend analysis. In this example, what if the man weighed 215 pounds four weeks ago? By trend analysis, you can assume that something is wrong, and he in fact is not healthy. That amount of weight loss over a short period of time is indicative of a potentially serious illness. Therefore, understanding the context of data can change the entire picture.

What outcomes can be derived from this information? It can take many forms. The person may understand the underlying issues and be able to self-correct, or he may seek further, more detailed analysis by visiting a doctor.

The relevance to the oil analysis industry is twofold. First, oil analysis is primarily focused on analysis and interpretation. The very nature of sampling indicates a single data point taken at a snapshot in time, i.e., a person’s weight measurement. This frequently is married to a static specification (or height/weight chart), and a result is given based purely on that single point in time (red, yellow or green).

Analysis and interpretation, with no context and rarely an outcome, are the norm. Outcomes appear at a later stage once a person has conducted a more thorough interpretation of that data, often with a significant time lag between sampling and outcome. I have seen many examples of an asset experiencing a catastrophic loss event during this time lag.

Secondly, compare data accuracy versus context. Many times, during discussions around some of the new real-time lubricant monitoring technologies/sensors, I am asked about the performance of the solution versus laboratory analysis. This is a great question with a simple answer. What are you looking for? Laboratories always will be able to provide a much more detailed analysis of lubricants. Sensors and sensing solutions will never fully replace the insight of a lab.

The sensor science just does not exist. Labs can offer accuracy levels to multiple decimal places and distinguish between different wear metal particles down to single parts per million. There will always be a need for this level of accuracy, but you must keep in mind your answer to the original question (what are you looking for?).

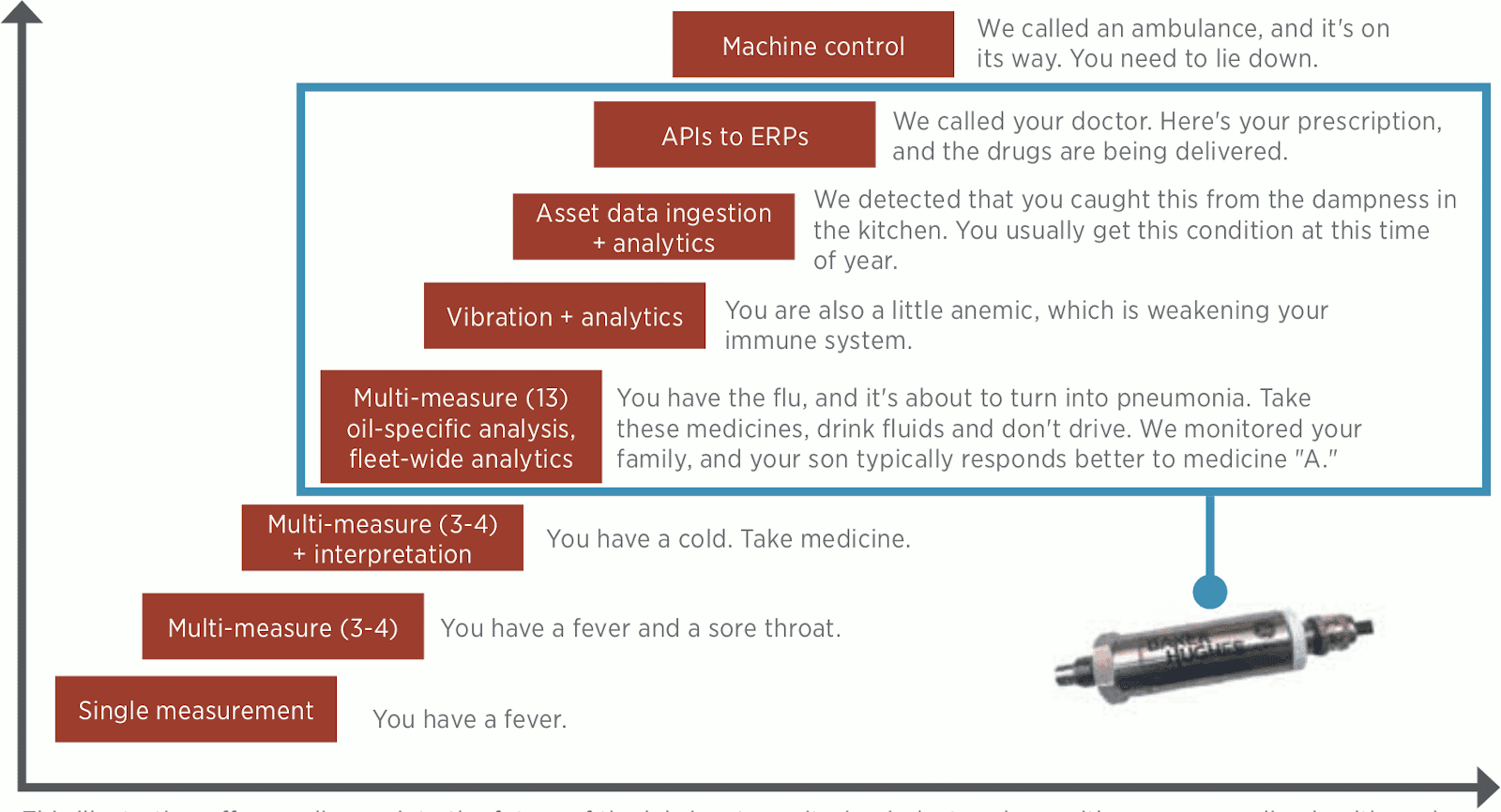

There are two clear and distinct paths to this question. On the first path, at the asset level, in real-time, during the running of the asset, you primarily need to know three simple things: is everything OK, what’s wrong and what should I do?

On the second path, after a major failure, the forensic analysis should be performed, an autopsy on a failed asset. In this instance, post-failure, many more questions need to be answered, such as why did it fail, what is the root cause and what do we need to address on other assets to prevent their failure?

The first path is where the need for new digital technology that drives real-time data comes into play. Data that is “good enough” but provides what you need to know (rather than what you can be told) is much more valuable in real-time with context than extremely accurate data taken at a single snapshot in time.

Consider again the person’s weight analogy. The man wears a device on his wrist that measures and tracks his weight and other health indicators such as blood pressure, heart rate, etc. The software on the wearable device can track the data trends and provide context as well as interpreted results based on known boundaries. This data is not as accurate as you would get at a hospital, where large machines would be used to measure each individual indicator.

However, the data is “good enough,” it’s in real-time, it tracks trends and therefore offers context. It has the four elements of good data: analysis (the device takes measurements and converts them into data), interpretation (it puts the relevant data into charts that show what the data means), context (it looks at trends over time and often has context around what activity you were doing at the time), and outcome (some devices now recommend actions based on the results).

Data that is good enough but shows context can often be much more valuable than precise data at a single point in time. For the lubricant monitoring industry, this is relatively new. Sampling has been the norm for a long time, with the focus more on accuracy and what can be told rather than what you need to know. Utilizing “good enough” data may rankle some industry purists, but I believe that is where this industry and many others are going.

Real-time Inline Sensing

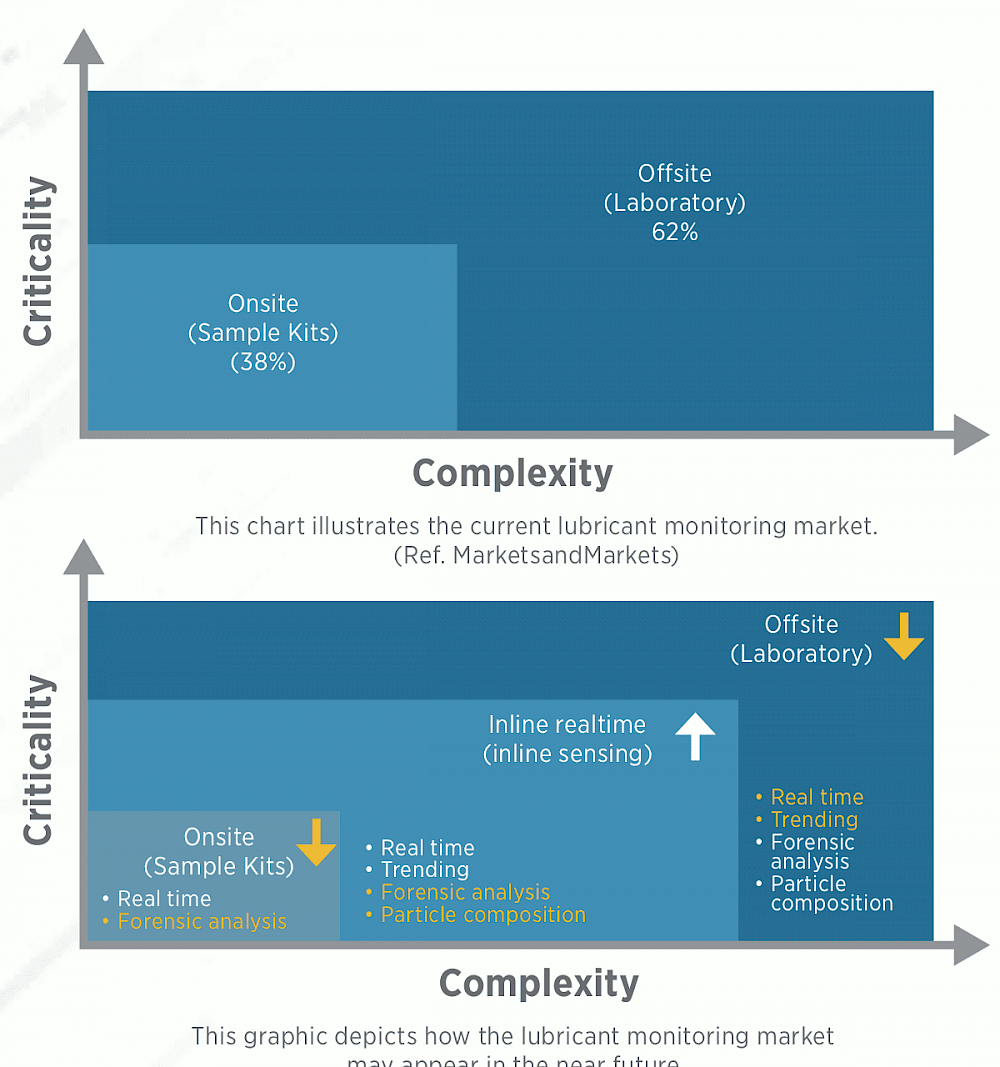

The emergence of real-time inline sensing is disrupting the industry. I often am asked what the impact will be on laboratories and sample kit providers, but no one has a definitive answer for how much disruption these inline sensors will cause. However, the nature of real-time analysis has obvious consequences for laboratories. If the emergence of “good enough” data takes hold, this will impact the market share of laboratories.

The only saving grace for offline sample kits over inline sensors is cost. The current cost of inline sensors is higher than a sample kit, even if the value of inline sensing outweighs that of a sample kit. Of course, the expectation with sensors is that the cost will come down over the next few years.

In fact, according to Rob Lineback of IC Insights, the cost of industrial internet of things (IIoT) sensors dropped more than 90 percent over the last 15 years. This trend undoubtedly will continue, and the price reduction will erode the sample kit market share over the next few years. Sample kits and inline sensors will become direct competitors.

Much has been written about the emergence of real-time oil analysis. Although this new technology is making strides, it still has limitations. Most real-time inline sensors are single measureands or at best measure two or three elements of lubricating oil.

They can provide good analytics and interpretation while offering a degree of trending, yet they seem to lack a more holistic approach to asset health. Measuring an oil’s viscosity, wear particles and water content or even trending these conditions can be useful and produce data that is good enough, but it doesn’t give you the whole picture of an asset’s health.

The Future of Lubricant Monitoring in the Digital Era

As stated previously, the digital era and the IIoT have largely been ignored by the lubricant monitoring industry (perhaps with some exceptions). We have seen how inline sensor capability has started to emerge by providing real-time, if not limited, insights. Where will or can this industry go in the future? I believe there will be several trends in this space, including increased measurement parameters (analysis), non-oil-based data ingestion (context), asset data ingestion (context), deeper machine learning (interpretation), ecosystem integration (outcome), and machine control (outcome).

The true potential of oil analysis has yet to be realized, and unlocking this potential is where I see the industry going. Adding more measurements, ingesting more data and then processing that data into meaningful, yet simple outcomes will be the first improvements, but it won’t be the end. No matter how good it is, data operating in isolation can be cumbersome. Integrating data and outcomes into an operator’s ecosystem and infrastructure is where the real value starts to materialize. Automating outcomes based on digital oil data is the ultimate goal, and it isn’t that far out of reach.

Moving Forward into the Digital World

Certain industries have been early adopters of Industry 4.0 and the digital revolution, such as the media, information technology and finance, while others are catching up fast, including oil and gas and advanced manufacturing. The lubricant monitoring industry has lagged far behind and arguably has yet to jump onto the digital train. This is surprising, as the potential for digital monitoring of lubricating oil is significant.

The industry is suffering from a lack of an incoming talent pool, with an ageing workforce and specialized skill-set drain. The adoption of digital tools and automated monitoring not only could help fill the gap in the talent pool but may also create new opportunities. Perhaps in the not too distant future, data scientists will be as much in demand as chemical engineers.

The rise of the digital era in lubricant monitoring doesn’t rely solely on converting analogue data to digital, replicating existing manual practices into digital visualizations of the same practices. At the core of this revolution lie bigger and more philosophical questions, such as “What do I need to know?” and “What do I do with the information?” Is there more value in “good enough” data, which shows “what I need to know” and is measured and communicated in real time, than exact accuracies taken at a single snapshot in time? I believe there is.

Data that not only offers analysis and basic interpretation but also includes context and simple outcomes and actions must be the way forward, especially as millennials enter the workforce.

Digital monitoring tools that can be incorporated into an operator’s ecosystem, can be accessed and acted upon by any skill level in the operation, and provide real-time answers to the three basic questions of “Is everything OK?,” “What’s wrong?” and “What should I do?” will be key to taking the lubricant monitoring industry forward into the digital world.