Base Oil Report

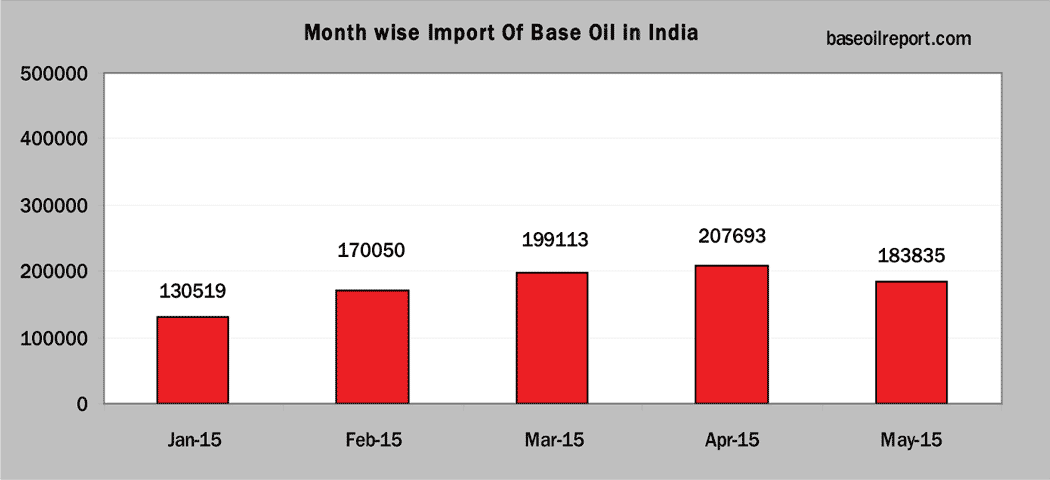

Contrary to the popular view, global crude oil prices moved up after a small dip in the aftermath of Iran reaching a deal with the US and other large countries on its nuclear programme. It would be months before any incremental Iranian crude oil reaches the market, with the timeline depending on several other factors. Under the circumstances, oil prices may not come down dramatically, but are likely to remain range-bound for 6-12 months, before any meaningful supply from Iran can tilt the balan. At its peak in 2007, Iran was producing nearly 4 million barrels a day (mbpd), of which 2.3 mbpd was exported. While its production suffered since mid-2012 post the US and EU-led sanctions, it averaged 2.8 mbpd in 2015 with exports of about 1 mbpd. There was a widely shared perception that there may be a glut soon after a deal. But no fresh supply from Iran would flow into the market before 2016, say experts. “By October 15, Iran must show that it has met its commitments and the International A .. By October 15, Iran must show that it has met its commitments and the International Atomic Energy Agency hopes to issue a final report by December 15.On the other hand, the US Congress has 60 days to debate over the deal before reaching a conclusion. The US President Obama has already clarified that he would veto any legislation preventing the deal. Even if everything moves as planned, it is not known how much incremental crude Iran could add to the global pool.During the period January 2015 to May 2015, India imported 891210 MT of Base Oil. The country imported 130519 MT in January, 170050 MT in February, 199113 MT in March, 207693 MT in April and 183835 MT in May 2015. Compared to the previous month i.e. April 2015. Base Oil import of the country has decreased by 11% in May 2015. Compared to the same month last year i.e. May 2014, Base Oil import had gone down by 13% in May 2015.

The Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the month of May 2015, approximately 183835 MT have been procured at Indian Ports of all the grades, which is 11% down as compared to April 2015, Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL basic prices for SN – 70/N – 70/SN – 150/N -150 marked up by Rs. 0.70 per liter, while SN - 500/N - 500 is jumped by Rs.1.20 per liter. Bright Stock price is up by Rs. 1.60 per liter. The prices are effective July 01, 2015. Hefty Discounts are offered by refiners which are in the range of Rs. 15.00 – 17.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 45.10 – 45.20/45.90 – 46.05 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

| Month | Group I-SN 150 Iran Origin | N-70 Korean Origin | J-500 Singapore Origon | Bright Stock Europe Origin |

| April 2015 | 610-615 | 660-665 | 700-705 | 910-920 |

| May 2015 | 640-645 | 690-695 | 730-735 | 940-950 |

| June 2015 | 640-645 | 680-685 | 735-745 | 960-970 |

| Since April 2015 prices have gone up by USD 30 PMT (5%) in June 2015 | Since April 2015 prices have increased by USD 20 PMT (3%) in June 2015 | Since April 2015 prices have firmed up by USD 35 PMT (5%) in June 2015 | Since April 2015 prices have surged up by USD 50 PMT (5%) in June 2015 |

The Indian domestic market Korean origin Group II plus N-60–70/150/500 prices at the current level have been marginally up. As per conversation with domestic importers and traders prices reflects minimal changes for N – 60/ N- 150/ N - 500 grades and at the current level are quoted in the range of Rs. 45.50 – 45.95/45.85 – 46.30/47.60 – 48.20 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs.0.35 – 0.45 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 45.50 – 46.00 per liter in bulk and Heavy Liquid paraffin (IP) is Rs.49.50 – 50.60 per liter in bulk respectively plus taxes extra.

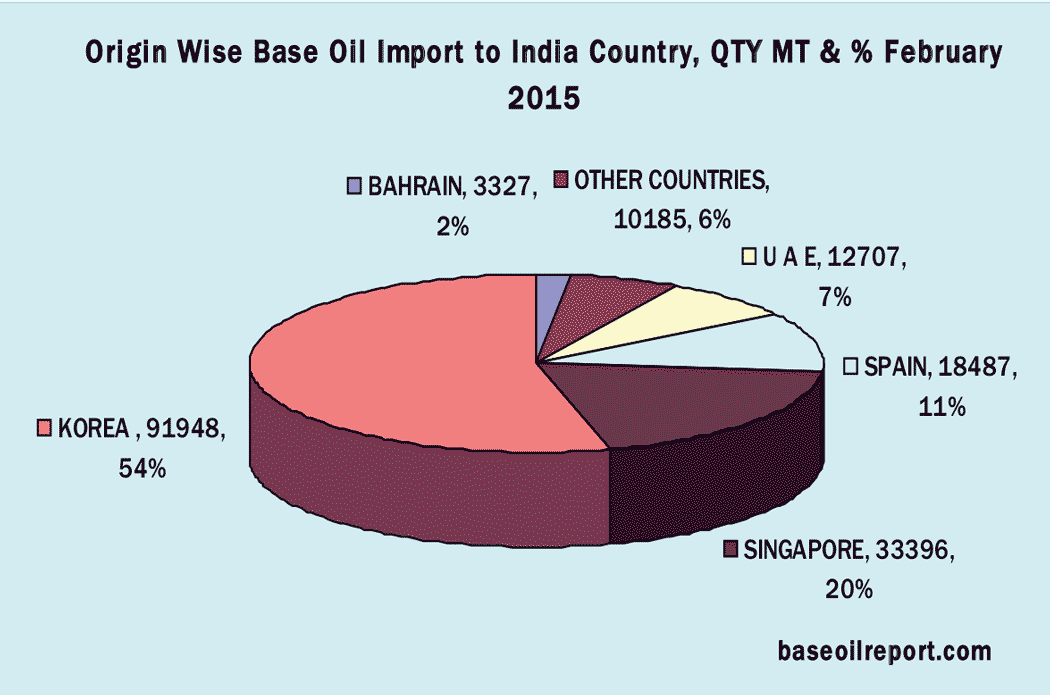

During the month of February 2015, India imported 170050 MT of Base Oil. The country imported 91948 MT (54%) from Korea, 33396 MT (20%) from Singapore, 18487 MT (11%) from Spain, 12707 MT (7%) from UAE, 10185 MT (6%) from other countries and 3327 MT (2%) from Bahrain. While in the month of February 2015, India imported 170050 MT of Base Oil, India imported the huge quantum in small shipments on different ports like 120721 MT (71%) into Mumbai, 32747 MT (19%) into JNPT, 7367 MT (4%) into Chennai, 4486 MT (3%) into Ennore, 3388 MT (2%) into Kolkata and 1341 MT (1%) into Other Ports.

Approximately 7325 MT of Light & Heavy White Oil has been exported in the month of February 2015 from JNPT. Compared to last month i.e. January 2015; exports of the country have gone up by 30% in the month of February 2015. It has been exported to Egypt, Iran, Puerto Rico and USA. Approximately 5583 MT of Transformer Oil has been exported in the month of February 2015 from JNPT, Village Ponneri, Raxaul LCS and Chennai. It has been exported to Bangladesh, Brazil, Indonesia, Iran, Korea, Kenya, Morocco, Myanmar, Nepal, Newzealand, Nigeria, Oman, Paraguay,Indonesia, South Arabia, South Africa, Singapore, Thailand, UAE and Vietnam.

Petrosil Base Oil Report (www. baseoilreport.com) offers solutions to the entire base oil value chain, from refiners, suppliers, buyers, traders, agents, consultants, lubricant companies, professionals and logistic providers as well as any other entity of the base oil value chain. Base Oil Report is a comprehensive marketplace for global base oil reporting and trading.

Our subscribers can use this exclusive and unique base oil gateway to access information from the different sections and post and reply to international base oil offers. The gateway offers integrated solutions and is an essential tool for members that want to enhance their trading opportunities and access timely base oil news, prices and analysis.