Base Oil Report

The weakness or strength of the Indian rupee will continue to be largely determined by the level and costs of the country’s crude oil imports. The Indian rupee will likely continue weakening over the long term; though in October it strengthened to around Rs. 62 per U.S. dollar, up from a low of Rs. 69 in late August. The trigger for the rupee’s 30% slide against the dollar from May to August was fear over their growing balance of trade and current account deficits. About 30% of India’s energy needs are met by petroleum. But some 80% of this oil is imported – the major factor behind the country’s ballooning trade and current account deficits. Crude oil prices rose in Asian trade on Nov 15, 2013 buoyed by hopes the US Federal Reserve will wait longer before scaling back its stimulus programme. New York’s main contract, West Texas Intermediate for December delivery, was up 46 cents at USD 94.22 a barrel, while Brent North Sea crude for January gained 14 cents to USD 108.42 rose 2.6 million barrels in the week ended November 8.

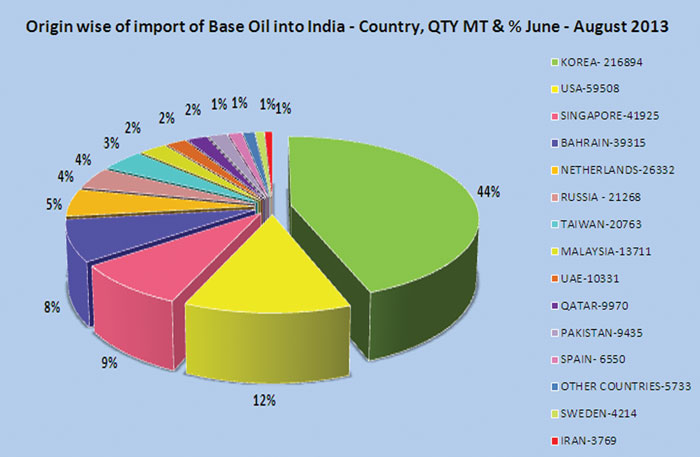

Indian base oil market remains steady with inventories at optimum levels with surplus of imported grades. During the period July to September 2013, approximately 500766 MT of base oils with an average of 166922 per month of all the grades have been procured at Indian Ports. Major imports are from Korea, Singapore, USA, UAE, Iran, Taiwan, France, UK, Netherlands, Japan, Italy, Belgium, etc. Indian State Oil PSU’s IOC/HPCL/ BPCL prices have been marked down effective from 1st November 2013. Prices for SN-70/H-70/ N-65 are down by Rs.0.40 per liter on its basic prices, while for SN-150/N-150/ H-150/Bright Stock-150 is down by Rs.1.30 per liter. SN-500/H-500/N-500 is marked down by Rs.1.80 per liter. Hefty Discounts are offered by refiners which are in the range of Rs. 12.00 – 18.00 per liter for buyers who commit to lift above 1500 MT. Group I Base Oil prices for neutrals SN -150/500 (Russian and Iranian origin) are offered in the domestic market at Rs. 62.65 – 63.05/63.55 – 64.10 per liter, excise duty and VAT as applicable Ex Silvassa in bulk for one tanker load. At current level availability is not a concern.

| Month | Group I - SN 500 Iran Origin | N-70 Korean Origin | J-150 Singapore Origin | Bright Stock USA |

|---|---|---|---|---|

| July 2013 | 980 – 985 | 985 – 990 | 1050 – 1055 | 1110 – 1120 |

| August 2013 | 965 – 970 | 970 – 980 | 1020 – 1030 | 1085 – 1090 |

| September 2013 | 940 – 950 | 1005 – 1010 | 1045 – 1050 | 1105 – 1115 |

| Since July 2013, prices has gone down by USD 40 PMT (4%) in September 2013 |

Since July 2013, prices has increased by USD 20 PMT (2%) in Sep- tember 2013 |

Since July 2013, prices has marked down by USD 5 PMT in Septem- ber 2013 |

Since July 2013, prices has remained unchanged in Septem- ber 2013 |

The Indian domestic market, Korean origin Group II plus N-60–70/150/500 prices marked up substantially due to sharp downfall of Indian Rupee. As per conversation with domestic importers and traders prices have been marked down for all the above grades and at the current level are quoted in the range of Rs. 61.40 – 61.75/62.75 – 63.10/64.50 - 65.90 per liter in bulk respectively with an additional 14 percent excise duty and VAT as applicable, no Sales tax/Vat if products are offered Ex-Silvassa a tax free zone. The above mentioned prices are offered by a manufacturer who also offers the grades in the domestic market, while another importer trader is offering the grades cheaper by Rs. 0.25 – 0.35 per liter on basic prices. Light Liquid Paraffin (IP) is priced at Rs. 62.60 – 63.20 per liter in bulk and Heavy Liquid paraffin (IP) is Rs. 69.15 – 70.30 per liter in bulk respectively plus taxes extra.

| Port | Qty in MT | Percent |

|---|---|---|

| Mumbai | 378853 | 77 |

| JNPT | 67678 | 14 |

| Ennore | 20548 | 4 |

| Chennai | 10005 | 2 |

| Kolkata | 8752 | 2 |

| Tughlakabad | 2537 | 1 |

| Others | 1346 | 0 |

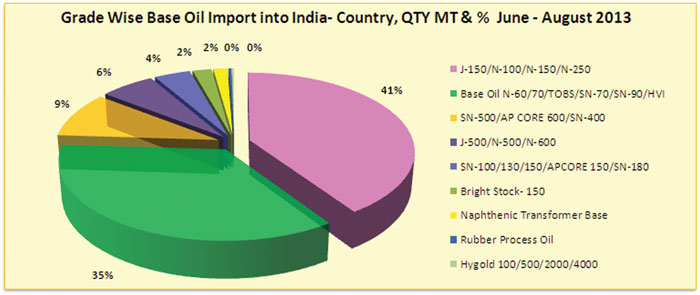

| Grade | Qty in MT | Percent |

|---|---|---|

| J-150/N-100/N-150/N-250 | 198535 | 41 |

| Base Oil N-60/70/TOBS/SN-70/SN-90/HVI | 173616 | 35 |

| SN-500/AP CORE 600/SN-400 | 46342 | 9 |

| J-500/N-500/N-600 | 29953 | 6 |

| SN-100/130/150/APCORE 150/SN-180 | 20006 | 4 |

| Bright Stock- 150 | 10537 | 2 |

| Naphthenic Transformer Base | 10537 | 2 |

| Rubber Process Oil | 1545 | 0 |

| Hygold 100/500/2000/4000 | 1330 | 0 |